BDC Update: Capital Southwest

January 29, 2024

Hot Off The Presses

Capital Southwest (CSWC) is the second BDC to announce IVQ 2023 results. At first blush - and before we dig into the 10-Q and listen to the conference call - the news is good. Earnings - as measured by Pre-Tax Net Investment Income Per Share (PTNIIPS) came in higher than what the analysts projected and at the highest level of the year. The $0.72 in PTNIIPS is likely the highest quarterly result ever. For 2023 earnings end at $2.71 per share, a 27% increase over the year before and 46% ahead of the 2021 result - the last year before rate increases.

Also Good

Net Asset Value Per Share (NAVPS) - despite modest unrealized losses in the credit and equity portfolio - also increased by 1.9% to its highest level since IVQ 2019. This validates our long-term projection through 2028 that CSWC can keep its NAVPS stable.

Undeterred

Management maintained the same $0.57 per share regular distribution in the IQ 2024 as in the prior quarter and the identical $0.06 special. In 2023 CSWC paid out $2.42 per share in total, very close to the $2.40 we projected. In 2024 - and through 2028 - we're sticking with the $2.40 payout. As of now - if we were to annualize the first quarter - CSWC is well ahead of our full-year estimate, but we're taking into account a possible lower payout in the second half of the year, which might see the special abandoned.

Valuation

Recommendation

.

September 20, 2023

All Together Now

Recently we've begun a program of co-ordinating BDC coverage across our three publications. The BDC Reporter undertakes timely financial analysis a given company based on the latest results; the BDC Credit Reporter reviews the credit status and the likely losses that might lie ahead and BDC Best Ideas - last but not least - combines all that information and undertakes a long-term valuation, including projections that reach 5 years out. In the past we've only projected out BDC distributions but are now adding recurring earnings (typically Net Investment Income Per Share) for the entire period.

At Bat

We have just completed the process for CSWC after much time spent with the BDC's latest 10-Q, many years of 10Ks, earnings press release, investor presentation, and conference call transcript. At the BDC Reporter, we wrote an article about CSWC's short and long-term outlook across key issues such as net asset value, earnings, credit, assets under management, and distributions. At the BDC Credit Reporter, we undertook our periodic Credit Review, which included updating our list of underperforming companies and their likely impact on the BDC's metrics down the road.

Latest Approach

Armed with all the above, we projected out the recurring earnings of CSWC through 2028. (By the way, our numbers are modestly more optimistic than the analysts whose estimates only go out two years). As you can see in the Expected Return Table, we expect CSWC will reach "peak earnings" in calendar 2023 and then see profits erode in future years due to the impact of expected lower interest rates from the Fed starting in the second half of 2024. By 2027, we project CSWC's favorite earnings metric - Pre-Tax Net Investment Income Per Share (PTNIIPS) - will have dropped to $2.44 from $2.68 expected this year. Baked into those numbers are a series of assumptions - some based on CSWC's disclosures - about average yield levels; incremental income from increased AUM; changes in borrowing costs, etc. As always, we remind our readers that these are educated guesses at best.

Stable NAV

Of late, we are spending a great deal of time evaluating what we expect to happen to BDCs' net book value per share in the future. Any BDC that can maintain or increase its net book value per share (NAVPS) is more likely to be able to sustain its earnings - everything being equal - and will be more attractive to investors. We rely partly on historical performance to determine future NAVPS results but also our views as the past is not always an accurate guide as to what lies ahead.

Sanguine

In the case of CSWC - whose NAVPS has decreased by (13%) in the past 5 years - we are optimistic and assume this metric will remain unchanged between 2022-2027. To be consistent, we are also assuming the terminal multiple used to value any "stable NAV" BDC should be 12.5x. Previously we had relied on historical valuation multiples and used 15.0x. That was when CSWC was booking incremental earnings from equity gains back in the day. In our assumptions, we don't foresee any material contribution from that source so we're downsizing the multiple accordingly.

Distributions

That's a lot of tweaking, but where expected payouts are concerned, we've made no alterations. For some time we've been projecting that CSWC will pay out $2.40 in 2023. Through three quarters has paid/announced $1.79 per share, which annualizes at $2.41. We expect the BDC will be able to maintain this level of annual payout - in a mixture of regular and special dividends - for years to come. Given that CSWC already has a treasure trove of "spillover income" of $0.34 per share - a number that should grow throughout the period - will make it easier for management/Board to keep pumping out an unchanged mix of dividends.

Valuation

Recommendation

April 27, 2023

Latest

Yesterday, Capital Southwest (CSWC) announced its distributions for the calendar second quarter of 2023. The BDC has increased its regular quarterly dividend to $0.54 from $0.53 and added a $0.05 "special" - unchanged from the prior quarter. That brings the payout level to $1.17 at mid-year and to $2.34 if multiplied by two for the whole year. Annualizing the latest payout brings the "running" rate of distribution to $2.36.

Encouraging

For BDC Best Ideas, whose track record in projecting CSWC's distribution level has left something to be desired, these numbers suggest we are on the right track. For calendar 2023, we've been projecting since January (see below) that CSWC will increase its total payment to shareholders to $2.4000. That's up from the actual result of $2.1800 in 2022 - a 10% increase.

Not Done Yet

We're expecting further distribution increases in the second half of the year that should bring the total payout to match or exceed our estimate. The BDC has not yet officially reported its latest earnings, but the analyst earnings per share consensus for FY 2024, which covers most of the period under consideration, is $2.54. Just in this calendar first quarter of 2023, the analysts are already expecting Net Investment Income Per Share (NIIPS) of $0.6100. The BDC itself offered up an earnings preview that promised $0.63-$0.64 of NIIPS.

The Best Is Yet To Come

CSWC - and the BDC sector generally - has not yet reached peak earnings. As we've stated before, we expect that the Fed Funds rate will peak in the IIQ 2023 or in the IIIQ. (This is not very original thinking, which is in line with the Fed's dot plot). Thanks to the time it takes for borrowers' floating rate loans to reset to current rate levels that means we won't see the highest level of BDC interest income - everything else being equal - till the back half of 2023.

Copycat

Like the Fed, we don't expect rates to come down at all this year, and only modestly in 2024. We'll either get a "mild" recession -something akin to being "mildly" punched in the face - or the economy will soldier on regardless. No drastic drop in the Fed Funds rate will occur under either scenario, which should continue to support BDC earnings into next year.

Sustainable

Going by the latest CSWC "regular" distribution of $0.54, which annualizes at $2.16, the BDC seems to be signaling what its longer-term payout level might be. Rightly or wrongly, though, we expect a combination of the distribution of earnings previously retained; a higher level of fee income as the economy recovers; an increase in yielding assets, and wider spreads on existing loans to keep CSWC's annual payout at $2.4000 indefinitely, as shown in the Expected Return Table.

Both Ways

As a reminder, we are valuing CSWC at the end of 2027 at a multiple of 15.0x its $2.4000 dividend. The high multiple is based on historical experience and reflects the ever-growing number of equity investments on the BDC's books which are likely to boost earnings - as they have in the past - during the more favorable times ahead. (CSWC is one of a handful of lower middle market BDCs that have a proven ability to generate profits both from recurring interest income and from harvesting capital gains from junior capital investments).

Valuation

Beaten Up

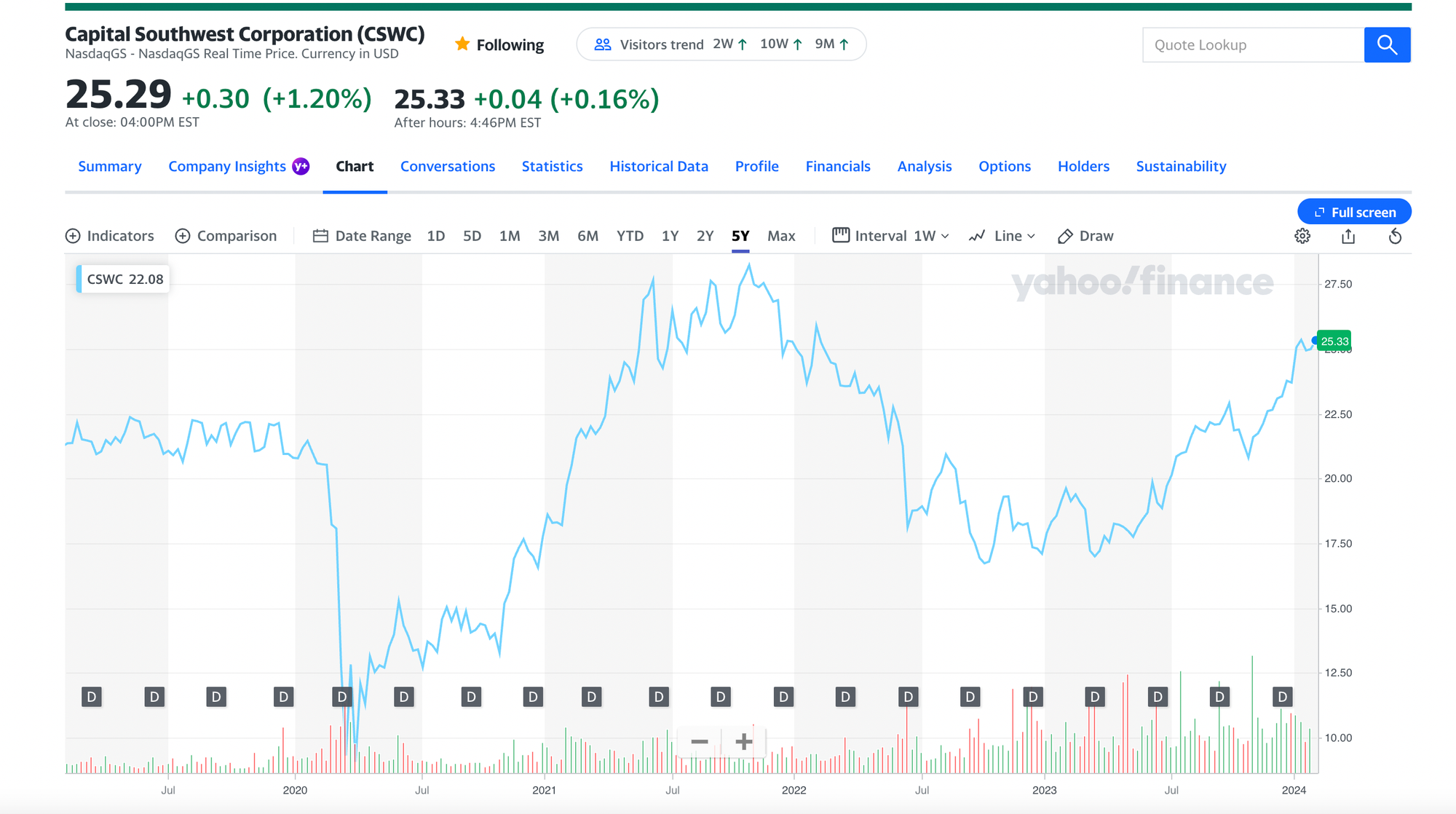

Admittedly, the very high prospective return rests partly on what might seem like an aggressive dividend multiple and high earnings. However, the big upside is also reflective of a BDC that has fallen out of favor with investors - at least by comparison with its prior own high levels. As this 5-year price chart shows, investors have been pulling back since 2021. In that year - thanks to a large "special" distribution - total distributions reached $2.5600. Since then, CSWC's stock price has dropped about (40%). In just the last year - according to Seeking Alpha data - the price has dropped (24%).

Will They Or Won't They?

Will CSWC ever return to its price heyday? We think so and are reassured by the example of another LMM-focused BDC with a similar business model - Fidus Investment (FDUS). They also reached a very high price level only to fall out of favor for years before coming back strongrecently, as this lifetime price chart shows:

More Conservative

Even when we played with the model and dropped CSWC's NIIPS from 2024-2027 back to $2.16 - the current level of the regular dividend annualized and with no special dividends - and reduced the terminal multiple to 12.0x from 15.0x, CSWC's return was superior. The total return over 5 years still comes to 113% or 22.6% per annum. That compares with the historic 5-year total return for the BDC - according to Seeking Alpha - of 109%.

Thumbs Up

Short of assuming a major drop in financial performance between here and 2027, CSWC seems to be a good bet for the long-term investor. (What will happen in the short term is anybody's guess). We expect the BDC's soon-to-be-released earnings to confirm our viewpoint.

January 31, 2023

Blushing

Apologies, but we're revising our projections for Capital Southwest's (CSWC) 5-year dividend outlook for the nth time. (The last time was around Halloween). Less than a year ago - as you can read for yourself if you scroll down to what we were writing in February 2022 - one of our principal concerns was that the BDC's portfolio yields were headed down, as the Fed kept rates low and competition for loans was strong, shaving spreads.

Who Knew?

What a difference war in Ukraine, high inflation, and a pugnacious Fed has wrought! CSWC has just reported IVQ 2022 results and its loan yield is now at 12.0%. A year ago, that same yield was 9.5%. The yield has increased by 26%. Assets under management have increased as well - by 33% - helped by new share issuance throughout the year.

Off

Now that we've seen CSWC's IVQ 2022 results - but not its 10-Q - we realize that both our dividend projections and the analysts' earnings estimates made even a few months ago are too modest. Let's start with the latter, who projected IVQ 2022 Net Investment Income Per Share (NIIPS) would be $0.56 but ended up being $0.62 - 11% above "expectations. The FY 2024 analyst EPS projection of $2.36 (which was $2.22 just 9 months ago) now seems far too low, and we expect to see upward revisions as the analysts go back to their computers.

Way Up

All the above is an excuse for our raising CSWC's 2023-2027 annual dividend projection to $2.4000, from $2.1800. (We expect NIIPS should range for the calendar year between $2.65-$2.70 - way above the $2.14 achieved in calendar 2022). This is mostly due to those higher interest rates paying off in a big way, especially given that CSWC is internally managed, benefiting its shareholders above all.

Like Magic

Even more remarkable is that CSWC should achieve those sorts of 2023 results while actually de-leveraging its balance sheet thanks to raising big dollops of equity capital recently and bringing debt to equity levels back from what we rate as a HIGH level to a MODERATE level - a very rare phenomenon amongst BDCs right now.

Eyes Wide Open

Yes, credit performance weakened slightly in the IVQ 2022 (although without a filing we can't give you details) and is likely to get worse. However - and here's the key issue - the benefits of higher rates, widening spreads, and low borrowing costs are so great as to obviate those downsides that at any other time would be a worry.

Latest Valuation

Conservative

Even if we use a Terminal Multiple of 12.5x - ignoring the potential realized gains CSWC might generate in the future, the Total Return over 5 years is still 111%, and the Target Price is $30.00. Also not too shabby.

Holding Back

It's a sign of the times that CSWC - whose results and outlook have gone from strength to strength all year - should open today at $19.20 - only 8x our projected dividend payout for the year, and with plenty of gas in the BDC's earnings tank. That's an irresistible opportunity for investors willing to take the threat of a U.S. recession in their stride.

October 31, 2022

Last Minute Bonus

Just a quick update because Capital Southwest's (CSWC) management surprised us by announcing a "special" distribution of $0.05 per share for the IVQ 2022 after already having set its quarterly for the same period. As a result, we've updated the 2022 "Divvy" to $2.1800 from $2.1300 in the Expected Return Table.

No Biggie

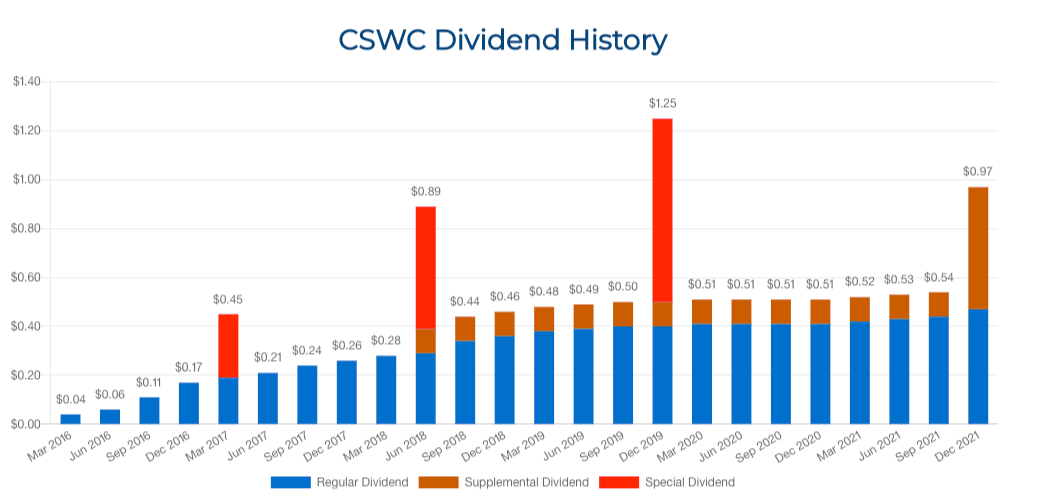

It's no big deal and does not affect our 5-year projections as we're already projecting 2023 through 2027. 2022 is now just history. For the record CSWC's 2022 payout is down from 2021 at $2.5600, but above the 2020 level of $2.0400. Best of all was 2019 - when CSWC was distributing proceeds from a major equity gain and paid out $2.7200.

Up And Down And Up...

This roller coaster ride reflects the debt and equity investment strategy that the BDC practices. Sometimes realized gains are high, some other times not so much. However, CSWC has raised its regular distribution in a more consistent, more drama-free way and is now up to $0.52 a quarter, or $2.0800 annually.

Reminder

The analyst consensus for EPS in FY 2023 is $2.2200. We project the calendar 2023 payout will be $2.1800, the same as in 2022. Starting in 2024, the projected total distributions reach $2.2000 and stay unchanged till 2027. As we write this, the Expected Return over 5 years is 98%. The yield - based on the 2023 expected payout - is 11.4%. Most of that should be in the form of "regular" quarterly distributions.

September 21, 2022

Acceleration

Everything is moving faster than usual in the BDC sector. On September 20, 2022, Capital Southwest (CSWC) announced an IVQ 2022 distribution of $0.52, up from $0.50 in the prior quarter and $0.48 in the quarter before that. At the same time, we noticed that the analyst consensus for per-share earnings in FY 2023 and FY 2024 had increased again. At the moment, FY 2024 Net Pre-Tax Income Per Share is set to be $2.2200. All this was discussed at great length in a BDC Reporter article.

Changes

As a result, we've updated the Expected Return Table with the latest earnings projections and confirmed - as we'd projected - that the 2022 actual payout will be $2.1300 per share. Given that we seek to use a 5-year rolling projection, we've added a dividend estimate for 2027. In fact, given the ever-higher EPS expected, we have increased the payout projected for every year from 2023 through 2027. We've chosen $2.2000 as the dividend for every year from 2024. The notion is that higher earnings from more SBIC lending and from higher rates will result in EPS plateauing at a 10% higher level than was achieved in the IIQ 2022.

Stellar Return

CSWC's stock price has been much battered of late, and at $17.93 is just off its 52-week low. This means that our Target Price - now $26.40 - is a ways off but still remains below its all-time high of $28.41. The BDC is trading at 8.1x projected FY 2024 earnings and 8.2x our estimated 2023 distribution. Our target multiple is 12.0x the terminal dividend. This results in CSWC offering a compelling 5-year return of 108%, or 21.7% per annum. The yield - using the 2023 dividend - is 12.2%.

September 15, 2022

Hard At Work

Over at the BDC Credit Reporter and BDC Reporter, we've been spending a lot of time reviewing Capital Southwest's (CSWC) credit status. This mostly involves marching down the BDC's list of portfolio companies, identifying the underperformers, and then digging into each of those in turn to ascertain what might be going wrong and the potential impact on the BDC's asset values and income.

Less Than Meets The Eye

We have a glance at CSWC's own investment ratings in its 10-Q, but these are limited to debt obligations and don't include a count on how many companies are not performing as expected, or any "color". The conference calls offer a little more detail, but not much. CSWC - like most everyone else - is in no hurry to disclose the reasoning behind the devaluation of its investments.

We Do It Our Way

As a result, we prefer to start from scratch with our own 5-point rating system. Anyway, after we had undertaken that process - which involves much data review of investment values over time taken from Advantage Data's records and multiple searches in the public record about the businesses, as well as mining our own database of company files that we've assembled over the years - we were surprised by what we found.

Taken Aback

In a nutshell, the number of underperforming companies - 12, including 4 non-performing - was higher than we anticipated, as was the percentage of total portfolio assets not going to plan (approx. 14% of $1bn of investments). Furthermore, at a time when we are always looking for canaries in the coal mine of much higher credit losses to come, there was 1 new non-accrual and 4 new underperformers in the IIQ 2022. All this is laid out in the Credit Review we wrote for the BDC Reporter.

Upside Potential

The value of underperforming assets remains within the bounds of what we consider "normal" - typically under 15% of the total. Moreover, the BDC has numerous equity investments that - one fine day - could result in realized gains that would offset some or all the hypothetical realized losses we fear. Have a look at Ninjatrader for an example of what we are saying, valued at nearly 5x the $2mn CSWC invested in its preferred.

Needle Moving?

We tried to determine if the prospective losses CSWC might face - including a "general reserve" we calculated on the performing assets were sufficient to change our 5-year dividend projection, as reflected in the Expected Return Table above. At the moment, we are assuming CSWC will pay out $2.1300 in 2023, rising to $2.2200 in 2024 and then declining to end in 2026 at $2.0400.

Sensible Enough

Given that CSWC has just increased its regular quarterly distribution to $0.50/$2.00 annually, and that the analysts expect earnings to increase to $2.17 a share in FY 2024, which ends in March of that year, our projection has seemed reasonable. Furthermore, and for what it's worth, the BDC still has $0.15 of undistributed taxable income per share to pump out.

Our Logic Summarized

To reach our 2024 dividend target, CSWC will need to increase its earnings by 10% over the IIQ 2022 level. With over $950mn of investment assets at cost benefiting from higher rates and the BDC likely to increase its portfolio size with additional SBIC-funded investments, the target seems reachable - even if there's some income erosion from higher bad debts than we might have expected.

Not Going There

What we're not budgeting for is a major credit downturn at CSWC in the quarters ahead, which would make all our projections irrelevant. This latest analysis, though, has made us more nervous that could happen, but that's not our investment thesis. Consider this just a heads-up, but we've decided not to change our dividend projections or our terminal price multiple.

Abandoned

We should note that the market does seem to have already fallen out with CSWC - maybe because of these credit risks. The BDC opened the day (36%) below its 52-week high and only 2% above its 52-week low. If it's any consolation, CSWC still trades at a (smallish) premium to net book value per share, but at a modest 8.4x multiple of those projected FY 2024 earnings per share. The yield - using the current regular payout - is 11%. Use our projected payout for 2023 and the yield is 11.7% and 12.1% in 2024.

Thumbs Down

These metrics suggest investors expect some modicum of bad news from CSWC, beyond and above the average. YTD the sector - as measured by BIZD - is down (9%), while CSWC is off (26%)...Given the malaise in the stock price, while we're still calling for a Target Price of $30.60, the prospective return in our model is very high: 122% over 5 years or 24.4% per annum. Somebody has got this wrong and we are clearly the "contrarian" here.

Another Perspective

We couldn't help but plug in a more conservative scenario. We assumed EPS would remain at the current of $2.00 per annum - giving up any increase in profits from rates and greater AUM to pro-forma credit losses over the entire period. We also reduced the 15.0x terminal multiple we've been using, reflecting the BDC's prior status as an investor favorite, to a "normal" 12.0x. Our target price drops to $24.96 - well below its historical record. The total return goes to 91% or 18.2%. Should that occur, that would hardly be a disaster.

Round Trip

So after all that back and forth we remain bullish on CSWC - but concede there are credit headwinds to contend with and a change of attitude in the market, as the stock price chart for 2022 shows:

We are nailing ourselves to the CSWC mast but will take another hard look when IIIQ 2022 results are published to see if we need un-nailing.

August 19, 2022

Capital Southwest (CSWC) reported much-unchanged calendar IIQ 2022 results FY IQ 2023) and raised its regular distribution to $0.50 for the quarter that ended September 30, 2022. The BDC Reporter annotated the BDC's latest conference call transcript, 10-Q, earnings press release, etc. Overall, this was a ho-hum, business-as-usual quarter.

Here's the rub. Without getting too specific, management made clear that they expect the third quarter of 2022 - and by implication the quarters beyond - to see substantially higher earnings. If true, that would also mean the BDC's regular distribution should be headed higher, the just-announced increase notwithstanding.

The main cause - maybe the only one - of the higher earnings going forward is higher rates. CSWC didn't really benefit from the initial rise in short-term rates during the IIQ 2022 given how long it takes for borrowers' loan agreements to reset to higher levels. However, since July that is happening and CSWC shared that if those rates had been in place through the entire second quarter its EPS would have been $0.53, rather than $0.50.

As we all know, rates have risen further since the end of June and more increases are on the way. As they say, it's not a matter of if the Fed will raise rates but how much and for how long. CSWC should be a beneficiary. In its latest 10-Q, the BDC - whose annualized EPS is running at $2.00, claims that a 100 basis point increase in the reference rate could increase net investment income per share by $0.25.

How long that might take and what offsets might occur - like income lost to credit defaults or a shrinking portfolio to keep leverage at more modest levels than in the past - is hard to say. We take the analyst consensus of $2.13 for FY 2024 with a pinch of salt because nobody can know for sure and there's another known unknown: possible net realized gains CSWC might distribute as a "special" dividend.

What we do know - almost certainly - is that CSWC's earnings and regular distribution are going up - and soon. In our model, we've upped the 2022 projection from $2.11 to $2.13 - most of which is already in the bag. In 2023, we're now projecting the payout will go to $2.2200, mostly due to rate increases. Only in 2024 do we envisage CSWC's distributions might shrink as the Fed starts to reduce rates. We're predicting - very roughly - $2.08 in 2024, dropping to $2.04 ($0.51 a quarter) in 2025 and 2026. That's pretty much where we were before for the latter years.

Still, the higher payout in 2022-2024 has boosted the 5-year total return prospects for CSWC, which compelled us to undertake this update.

February 1, 2022

Headed South

Ironically Capital Southwest (CSWC), which has just kicked off IVQ 2021 earnings season on January 31, 2022, with excellent earnings growth (up 13% over the IIIQ 2021 results) is also one of only 6 BDCs that we expect to pay out a lower aggregate distribution in 2022 than in 2021. Adding to the irony, CSWC just raised its regular quarterly distribution to $0.48 for IQ 2022, from $0.47 in the last quarter of 2021.

Well Running Dry

The drop is because CSWC is no longer paying out a special distribution or supplemental distribution as was the case for the last several years. Undistributed taxable income, derived principally from net realized capital gains, has been shrinking fast because of multiple generous payouts in excess of recurring taxable income. A year ago, CSWC had $1.09 of undistributed taxable income per share. This quarter, the number has dropped (71%) to $0.32.

Dividend Strategy

Instead, CSWC is following the example of Saratoga Investment (SAR) and of Main Street Capital (MAIN) and seeking to increase its regular distribution consistently. For IQ 2022, the BDC has already announced a 1c per share increase in the regular distribution to $0.48. Like SAR and MAIN, CSWC can afford to gradually increase its distribution in this way - which many investors find very reassuring - by not paying out all earnings achieved (in the IVQ 2021 distributions equaled 92% of net income before tax) and because overall earnings are still in growth mode. We refer you back to that 13% growth metric above.

Doing The Math

Nonetheless, the bottom line is that CSWC paid out $2.56 per share in distributions but is currently on a running rate ($0.48 x 4) of $1.92 in 2022. That's a not negligible (25%) drop. If it's any comfort, we have been projecting CSWC will actually pay out $1.98 in 2022 as we're expecting the 1 cent increases to continue all year, funded by slight EPS growth; the undistributed taxable income and paying out a greater percentage of what is earned.

Topping out?

However, the BDC has already leveraged itself to 1.23x to 1 debt to regulatory equity, leaving very little room for asset growth. The exception to that statement is adding on further SBIC assets by contributing more equity to the SBA subsidiary and borrowing very cheaply with SBIC debentures. Offsetting incremental income from that source, though, is likely to be a lower yield on investments (just this past quarter the yield on debt dropped from 9.7% to 9.5%) and - one would expect - modest credit losses, even if there are only a few worrisome companies at the moment. We're also concerned about performance and income at CSWC's joint venture with MAIN.

Dividend Outlook

As a result, we're projecting CSWC's annual dividend will top out at $2.04 a share from 2023-2026. That's a high 12.6% return on equity, using the latest net book value per share as the denominator and the dividend estimate as the numerator.

Possible Bonus

The wild card this year, and for every year to come, will be what happens in terms of net realized gains. CSWC - like MAIN and SAR - has many equity stakes, which could generate tidy returns, and more than offset any investment losses. In turn, management is likely to pay out those gains in the form of supplemental dividends as before. For all we know, some of the remaining $0.32 in undistributed taxable income may already be earmarked for that purpose. In our projections, though, we've made no accommodation for any supplemental payouts as these are very hard to count on.