BDC Update: Midcap Financial Investment

January 26, 2024

Back Again

We've "updated" MidCap Financial (MFIC) twice before - just scroll down as we write in reverse chronological order. The last time was February 22, 2023, just about a year ago. Now we're having another go, trying to take into account the impact through 2028 of lower interest rates - a very difficult factor to quantify. A new factor in the mix with MFIC are pending mergers with Apollo Senior Floating Ratio Fund Inc. (NYSE: AFT) and Apollo Tactical Fund Inc. (NYSE: AIF), announced on November 7, 2023, but not yet consummated.

As of September 30, 2023, AFT and AIF had net assets of approximately $234 million and $212 million, respectively, or $446 million on a combined basis. The fair value of AFT's and AIF's portfolios were $346 million and $311 million, respectively, or $656 million on a combined basis. Directly originated loans make up about 23% and 33% of AFT's and AIF's portfolios, respectively, or 28% on a combined basis. The balance of the portfolio primarily comprised of liquid assets, including broadly syndicated loans, high-yield bonds and structured products in the case of AIF.

Management promises that these mergers will enhance the profitability of the BDC; pay out a one-time $0.20 per dividend and increase trading volume of MFIC's stock. See the latest earnings conference call for many more details.

Sharpened Pencil

This combination makes an already difficult job that more problematic, but we've taken the bull by the horns and revised our earnings and payout projections from 2024 through 2028. (2023 is almost complete where EPS is concerned and distributions are complete for the year). Very importantly, we've also changed our outlook for what is likely to happen to MFIC's net book value per share (NAVPS) in the years ahead. Previously, we expected a modest erosion of NAVPS but the change in business strategy that began even before MFIC changed its name from Apollo Investment (AINV) has given us hope that the BDC can generate "stable NAV".

The BDC itself is one of (too) many that does not undertake a quarterly investment rating of its portfolio. All we know is that MFIC has 4 companies with debt on non-accrual but with a very modest $1mn of fair market value - i.e. not much of a factor. Our sister publication - the BDC Credit Reporter - has undertaken its own independent analysis and found there are 16 underperforming companies in MFIC's 149 entity portfolio. That sounds high-ish, but the Credit Reporter has drilled deeper and found only 4 of the 16 are Important Underperformers - rated 4 or 5 on their 5-point scale AND with an FMV of $5mn or more. The other 12 are either rated CCR 3 - only modestly underperforming, and/or with very little remaining fair value. One example amongst many is portfolio company MSEA Tankers. The BDC still have $15mn invested in what was once a core strategy but the remaining value is just $50K...

De Minimis

The total value of the 4 Important Underperformers comes to $38.2mn and the Credit Reporter estimates additional write-downs might reach ($16mn). That's very little - less than (2%) of MFIC's net book value and could well be offset by future equity gains; selling new shares at a premium; retaining a portion of earnings or undertaking an accretive merger. We strongly believe that the MFIC of the next 5 years will look much better than in the 5 years just past, where NAVPS dropped (21%). Already, MFIC has increased its NAVPS for the past 3 quarters in a row.

Earnings Outlook

In 2023, MFIC's Net Investment Income Per Share (NIIPS) seems likely to be $1.7500. That's a 20% increase over the last 2 years - nowhere near as good a performance as many of its peers as the BDC spent much of the time re-imagining itself, but still better than a slap in the belly with a wet fish. We see NIIPS holding up well in 2024, but still declining as interest rates drop in the second half of the year. The decline in NIIPS is projected to continue - albeit at a modest pace - through 2027, to reach $1.6000, and level out from there. By way of comparison, MFIC's NIIPS in 2022 was $1.5700.

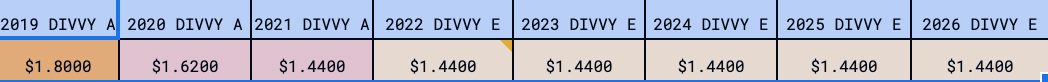

Dividend Outlook

The 2023 dividend payout was $1.5200 per share. (Like everyone else, MFIC has been holding back a good portion of earnings this year and last). This was 8% higher than in 2022, but remains well below the $1.8000 payout in 2019. The current payout is HUGELY below the $6.0000 a share annualized pace that MFIC (then AINV) was paying in its heyday. Those sort of comparisons are a reminder why the BDC needed a full make-over: new strategy, new management and a new name. Going forward, we project management will seek to maintain the current dividend level through 2028. If we're right about the payout and the stable NAVPS, MFIC's return on equity (ROE) will be 10.1% and 10.6% using projected 2028 earnings. That seems plausible.

Valuation

Recommendation

February 22, 2023

Doing Well

MidCap Financial (MFIC) has reported IVQ 2022 results, published its 10-K and Investor Presentation, and held its earnings conference call. In a nutshell, we were impressed by the performance across the board - in line with our expectations. If anything, recurring earnings came in stronger than we expected but that may have much to do with the quirks of the "total return" compensation plan.

Re-Think

MFIC is doing so well that we considered increasing our dividend projection for 2023 and beyond. On reflection, though, we're sticking with the assumption that the BDC will bring its annual payout up to $1.5800 in 2023 and stay there through 2027. In IQ 2023, MFIC announced a distribution of $0.3800, up slightly from the prior quarter. That only annualizes to $1.5200, but we expect greater payouts as the year progresses.

Up To Date

Reviewing our prior writings, we realize that we'd not written an update since our last article on July 10, 2022. - see below. At that time we were projecting MFIC would pay out $1.4400 in 2023-2027. Somewhere along the way we upped the projection but failed to write an explanatory update. This brief update syncs up the Expected Return Table with our Update.

Valuation

July 10, 2022

Not Right

MFIC (till recently Apollo Investment, with the ticker AINV) is one of the oldest public BDCs, launched by its famous parent/sponsor/advisor Apollo Global (APO) back in 2004. Unfortunately, for many years the advisor could not find the right formula, circulating through strategies and managers, with little success. MFIC initially invested heavily in second lien and junior capital investments and then went on to specializing in industries like shipping, alternative energy, and oil & gas. As you might imagine, these initiatives did not go well.

Switch Up

Then, in 2013, APO acquired middle market senior lending platform Mid Cap Financial. This provided a platform for serving mid-sized borrowers - typically the bread and butter business of BDC activity. In 2016, AINV also named the co-founder of Mid Cap - Howard Widra - as President (and later as CEO). The new manager's mandate has been to re-position the BDC's portfolio - by taking advantage of Mid Cap - into senior loans to middle-market private borrowers and dispose of those unsuccessful "legacy" assets.

Sweet & Sour

In the six subsequent years, the MFIC team has successfully reshaped the portfolio into sponsor-backed first lien loans, originated almost completely by MidCap Financial. Just as intended - this "corporate loan portfolio" - may yield substantially less than prior strategies, but has proven resilient from a credit standpoint, greatly reducing volatility in performance. Unfortunately, over this same time period, AINV has taken a great deal of time extracting itself from those "legacy assets" whose poor performance has weighed down book value and hampered earnings. Only in 2022 have these assets been dropped as a category, as their number and value have been whittled down to less than 5% of the total and still dropping.

Latest Problem

Unfortunately, just as the "legacy assets" are leaving, the BDC is facing another challenge inherited from an earlier period: its investment in aircraft leasing in the form of Merx Aviation. Since 2012, the BDC has been the vehicle chosen to finance and own this major commercial aircraft lessor. The airplanes themselves are financed by third-party securitizations, but the junior capital is provided by MFIN. The amounts involved are substantial, representing more than a tenth of the BDC's total assets.

Get Out

Merx was first battered by the impact of the pandemic on aviation and then by the loss of multiple aircraft in 2022 to Russian lessees after the U.S. imposed sanctions in the wake of the Ukraine conflict. Now, the BDC is negotiating with its insurers for the reimbursement of the loss. This setback seems to have compelled the Apollo organization to reconsider the aircraft leasing business. Since the spring of 2022, the BDC has formally committed itself to sell off the aircraft fleet, but it is unknown when the process will be complete.

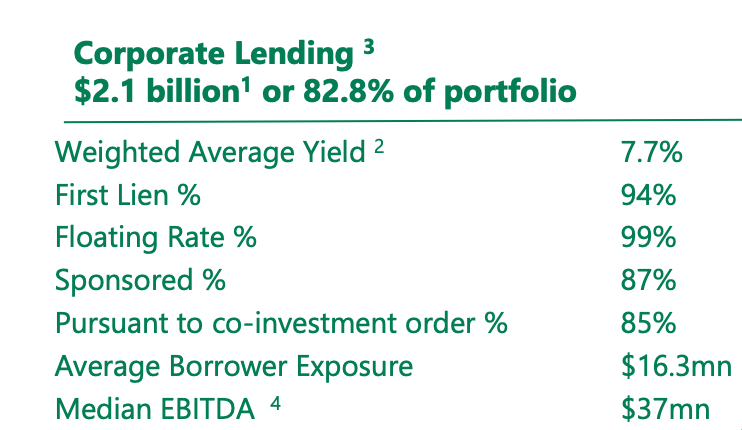

However, when that does occur - and the "legacy assets" continue to slip away - MFIC's business model will be much simplified. Essentially, the BDC will be one of many pockets for tranches of senior secured loans booked by MidCap Financial, with a smattering of second lien and small equity stakes in these same businesses. Here is the most recent snapshot. Now assume that instead of 83% of the portfolio, this "corporate lending" becomes 95%-100% once Merx is removed.

The hard truth is that first-lien middle market lending does not generate a very high yield, as the table above makes clear. The BDC has sought to boost its earnings since Mr. Widra took over by lowering compensation costs to the adviser (including agreeing to a total return calculation which cuts the incentive fee when net asset value drops). Nonetheless, the BDC remains in the middle of the pack where fee levels are concerned. MFIC also targets a higher than the BDC average debt to equity of 1.6x (most BDCs of comparable size are targeting 1.0 - 1.25x).

Due to its checkered past, MFIC is not yet able to borrow unsecured debt at rock-bottom yields and still relies on its one and only secured revolver for two-thirds of its debt financing. We expect this will change over time as the Merx and "legacy assets" leave the scene, providing would-be lenders to the BDC with a highly granular and safer base of assets to lend against.

The good news - especially going into a recession - is that the senior loans in the corporate lending portfolio should hold up better than most. Certainly, since Mid Cap came on the scene there have been few credit missteps in this now dominant segment of AINV's portfolio. Furthermore, the loans are highly diversified by industry and by the number of companies involved so a credit mistake here or there won't upset the whole BDC apple cart. Moreover, when defaults do occur, sitting at the top of a balance sheet gives AINV/Mid Cap plenty of power to maximize debt recoupment through a sale of the business; restructuring or even liquidation.

Long term, we are sanguine about the eventual turnaround of AINV, despite the many years already gone and the remaining challenges at Merx and in the last "legacy" assets. Ironically enough, we expect that credit losses at the BDC will be lower than the industry average in the next 5 years after years n the credit dog house.

PROJECTIONS

Over the next 5 years - from 2022 through 2026 inclusive - we expect AINV will maintain an unchanged annual distribution of $1.4400. However, the composition of the earnings will change as contributions from Merx and "legacy assets" shift to almost exclusively income from corporate loans. Maintaining the distribution during difficult times will be the "total return"