Fed Watch: Thoughts On The Latest Fed Meeting

September 20, 2023

Oblige Us

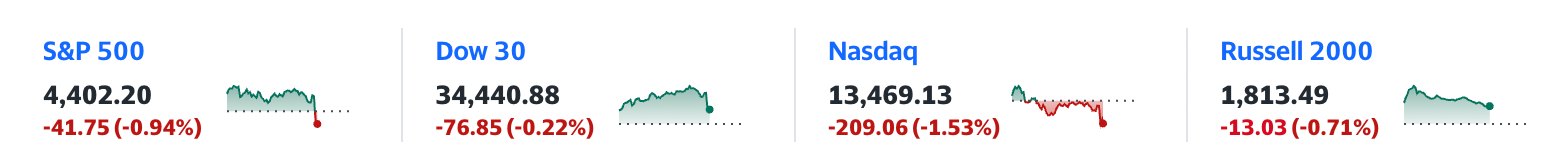

If you can stand another financial article about the Fed and what they're going to do where interest rates are concerned, please read on. We feel impelled to make some comments shortly after the Fed meeting and the Chairman Powell press conference and after all the major indices dropped to varying degrees after the close.

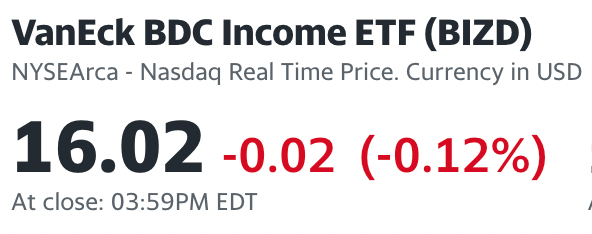

Even the only BDC exchange-traded fund - BIZD - was down (modestly) on the day.

Good For Us

Our principal point is that the prospect of a November rate hike - which remains on the table - and fewer rate cuts in 2024 than previously projected on the Fed's dot plot (1 now versus 3 previously) may be bad news for much of the market but not for BDC investors.

There is a good chance that the very high yields BDCs have been able to charge both in the back half of 2022 and through 8 months of 2023 could continue for another year. Or more.

The BDC sector is already about to benefit from the 0.25% rate increase previously decided in July, which will show up in IIIQ 2023 results and beyond.

A potential 0.25% increase in November would boost the IVQ 2023 and be fully reflected in the IQ 2024.

Even if the Fed ultimately starts to reduce rates late in 2024, the average loan yield for next year could equal or exceed the 2023 number.

This a gift for BDC lenders of still-higher investment income and for longer, while continuing to benefit - to varying degrees - from having much of their own borrowing costs fixed in unsecured notes.

Pencil Sharpening

Don't be surprised to see the analyst earnings projections for 2024 that have mostly been pegged as dropping from the 2023 level to start reversing course.

Undisturbed

Nor are we worried at this point that these higher debt costs will cause some cascading catastrophe as more and more leveraged borrowers become unable to meet their debt service.

The data from the BDCs shows that - with only a tiny number of exceptions - borrowers are gritting their teeth and paying their pipers.

Good Times

That's because the economy - as the Fed will tell you - is performing well enough; the supply chain challenges are behind us and even higher labor costs, which have been in a kick in the teeth for several industries, are moderating.

Likewise, the private equity sponsors that figuratively stand behind most of these leveraged companies, are stepping up to support all but the most troubled borrowers when needed.

Coming Soon

That strong-ish economy also figures into the universal increase in M&A and lending activity which is expected to show up in the second half of the year, adding another source of higher income for many BDCs.

Interest Rate Averaging

Further down the road, the possibility that the Fed even in 2025 and beyond will be in no hurry to bring down rates is also encouraging for BDC profits.

Anybody who is worried that the 2022-2023 rocketing of rates would be followed by an equally rapid descent should breathe more easily.

We don't anticipate that the Fed Funds rate will reach 2.50% - from 5.5% currently - till 2027 and may average over 4% over this 5-year period.

Back in 2021, the base rate was 0.15%, although most BDCs were using a "floor" of 1.0%.

Green Eyed

No wonder Bloomberg reported today that Apollo Global is raising $2.5bn to invest in private credit.

The fund will add more cash to Apollo’s $50 billion of assets under management in direct lending. AOP II will have similar targets as the first generation of the fund, which focused on large corporate borrowers — firms that generate in excess of $100 million EBITDA — primarily in North America and Western Europe, according to an August press release.

...The likes of Oaktree Capital Management, HPS Investment Partners and Ares Management Corp. have recently launched mega-funds for direct lending strategies.

The Masters Of The Universe have recognized for some time that there has been a secular shift in the cost of capital that will last many years and benefit lenders of all stripes.

Balance

Turnaround is fair play because for many years the borrowers have been in charge of the asylum - requiring ever lower spreads; looser terms and much else besides. In our opinion, much of the huge increase in corporate bankruptcies we've seen this year is a result of weak underwriting during the "easy money" years when a lot of companies that didn't deserve financing received it anyway.

Unsullied

Thankfully - the data collected by the BDC Credit Reporter and the BDC Reporter suggests that public BDCs both large and small mostly avoided the more marginal credits and remain in good shape with defaults and bankruptcies well within normal limits even as the rewards for lending have grown exponentially.

Caveating

Of course, if the Fed is wrong about the outlook for the economy and we get a sharp downturn in the economy matters will get more complicated. Borrowers will be more strained and interest rates could drop much faster than currently anticipated.

This won't be some dramatic "death blow" for the BDC sector like the one that almost occurred in 2008-2009 but earnings and distributions will drop and credit losses will rise.