BDC Update: Saratoga Investment

February 15, 2024

Up

Saratoga Investment (SAR) has just announced its 2024 fiscal fourth quarter distribution - which we consider the calendar 2024 first quarter. The BDC increased its quarterly payout to $0.73 per share. This is the 8th consecutive quarterly increase in the BDC's dividend. Management can afford to make these incremental increases because the amount of its quarterly payouts is WAY below its recurring income.

In-Line

BDC Best Ideas is projecting SAR will pay out $2.92 per share in all of calendar 2024, breaking last year's record (under this management team) of $2.82. With this quarter's increase, SAR's annualized dividend has already reached our projection. If the BDC continues to raise its dividend every quarter, 2024 will see an ever-higher-than-anticipated payout: $2.98. We'll revisit our projection later in the year as we hear more from the BDC's management.

Latest Yield

As we wrote about below on January 10, 2024, SAR's stock price took a hit after its latest results were published due to concerns about a new non-accrual; an above-average drop in net book value per share; the possibility that future distributions might be paid in stock and the high leverage of the BDC. At the time, SAR's price had dropped to $23.34 from a recent closing high of $26.34 before the results were announced. Today, SAR opened at $22.92 and has - at times - traded even lower. Anyway, at its opening price, a $2.92 payout generates a robust 12.7% yield. If SAR does pay out $2.98 in 2024, the yield could be even higher: 13.0%.

Recommendation

January 10, 2024

Saratoga Investment (SAR) - thanks to being on a reporting schedule that begins one month before everyone else - has kicked off the IVQ 2023 "earnings season" causing quite a stir. The BDC's favorite earnings metric - Adjusted Net Investment Income Per Share (ANIIPS) fell quarter over quarter by (7%) from $1.08 to $1.01. More distressingly for shareholders accustomed to ever-higher net book value, NAVPS fell by (3.6%). Much of this was related to the unrealized depreciation of multiple portfolio companies, which also included adding Zollege PBDC to the non-accrual list. (We're up to 3 names. Any subscriber to the BDC Credit Reporter can read our just completed Zollege update). Another bone of contention - but a perennial issue - is the BDC's high debt to equity, when all the former is counted.

Push Back

The result of the BDC's normally long but placid conference calls was a great deal of hullabaloo. There were all the questions you'd expect from several analysts about the troubled portfolio entities (including SAR's managed CLO). However, there was also a very "frank' exchange initiated by Compass Investment's Casey Alexander regarding - of all things - the new equity being issued by SAR in recent months. Here's a copy of the conference call transcript, but - in a nutshell - the analyst seems to be unhappy that SAR has been issuing new shares at a time when its stock price is slightly below its NAVPS, even though the manager is making up the difference. The CEO of SAR - Christian Oberbeck - gave a very comprehensive response which we're satisfied with, but not everyone might feel the same.

Retort

By the way, we particularly enjoyed this dig - for want of a better word - by CEO Oberbeck:

...We're sort of slightly puzzled by getting so much pushback on selling equity when analysts like yourselves are asking us about our leverage ratio. We would think we would get maybe more – applaud us for raising equity that is improving that metric on that side, recognizing that the next question everyone has is like, well, are you going to deploy it and increase your leverage again?

One More

Another issue raised by Mr. Alexander - again in what reads on paper like a rude manner ("Well, I think you know what I mean") - is whether SAR might choose to pay some or all its earnings/dividends in the future in the form of stock rather than cash. This is a question that does not come up on BDC conference calls very often, especially when earnings are bountiful. However, years ago SAR - when it was much smaller and less profitable - used that loophole in the BDC rules to pay out earnings with additional shares. If that were to occur again, we'd guess that there would be a race for the doors by some investors. Regardless of the brusque tone of the analyst, this is a fair and important question. Unfortunately, SAR did not reassure in its answer:

Christian L. Oberbeck Saratoga Investment Corp. – Chairman, CEO & President

Well, I think you obviously know that, that is an option. Yes, absolutely. That – the statutory requirements for BDC is to pay out anything is – has an option for a stock issuance. So that is – option that is out there. We have not made a decision 1 way or the other on how to address that.

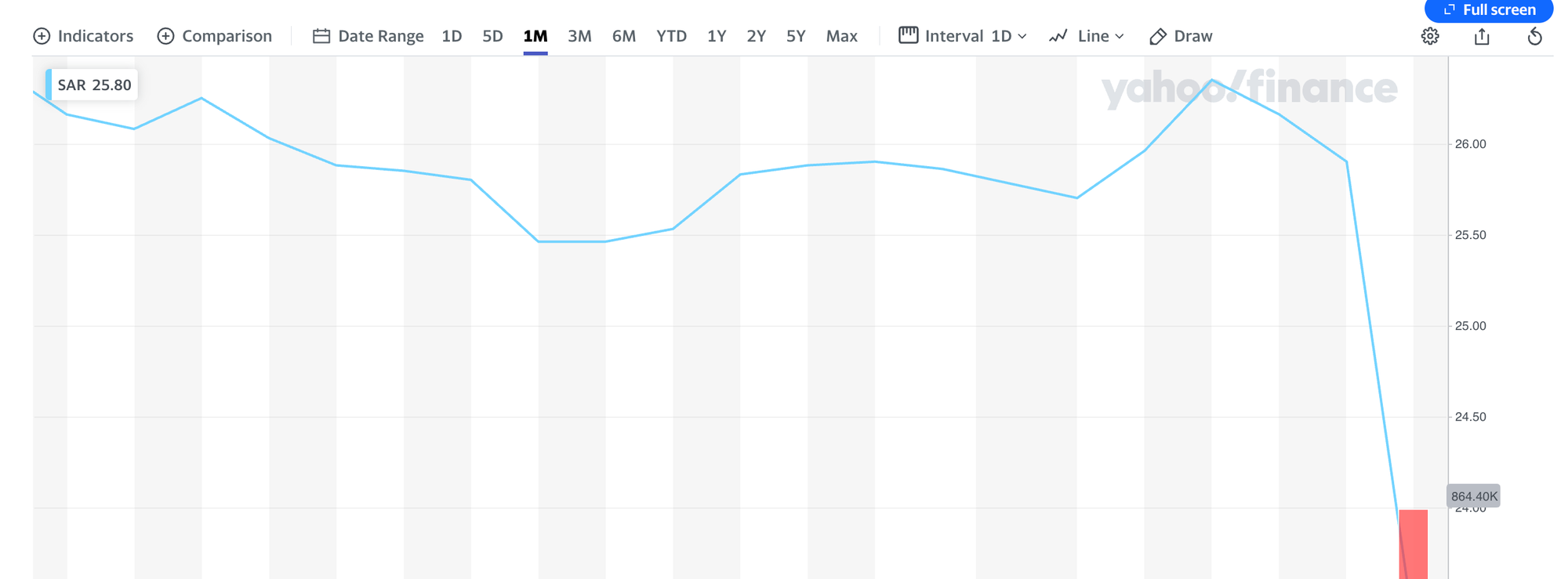

Downward

All this drama and the weaker-than-expected results have caused SAR's stock price to dive by (10%) on the first day after the earnings release as this Yahoo Finance chart shows:

SAR closed at $23.34, (19%) below its 52-week high and (15%) below its latest NAVPS.

Performance

With these results, we can close out 2023 for SAR (which is really December 1, 2022-November 30, 2023) and report ANIIPS came to $4.15 from $2.41 for 2022 - a 72% increase. See the Expected Return Table. NAVPS has dropped (3.6%). The total dividend payout comes to $2.82 per share in these twelve months, with the latest quarterly distribution annualizing at $2.88. The return on equity - using the average NAVPS and the ANIIPS - is 14.9%. The dividend yield for 2023 is 10.1%.

Outlook

In calendar 2024, we're expecting SAR's ANIIPS to drop to $3.56, but that's a very rough estimate given interest rate uncertainties, but does assume no further loan default. We now expect only one $0.01 per quarter dividend increase during the year, bringing the payout to $2.92 this year. By 2028 - and this is even rougher - we envisage the total payout with have increased to $3.00 per share. Likely lower earnings coming in the years ahead will not have much impact on distributions, as SAR is keeping a huge gap between what is earned and what is paid out. We should add that we don't expect SAR to shoot themselves in the foot and pay any portion of their dividend in stock, but one never knows. If that does happen, all bets are off where our valuation is concerned.

Valuation

Recommendation

November 15, 2023

All Done

We've just heard from Saratoga Investment (SAR) that its dividend for the quarter ended November 2023 - and presumably the last of this calendar year - has been increased to $0.72, from $0.71 in the prior period. This brings the BDC's total payout to $2.82. That's above the 2022 level of $2.81, which included 5 payments. We had projected SAR would pay shareholders $2.90. We're just 3% off and consider our projection - where we give ourselves a 5% room for maneuver in either direction - in line with expectations. The Expected Return Table has been updated accordingly, reflecting 2023's dividend performance.

Looking Forward

We've not yet undertaken a full 5-year earnings and dividend projection in the Expected Return Table through 2028 for SAR. However, we remain confident about our payout projections through 2027, which foresee a steady increase in total distributions, reaching $2.98 next year and $3.20 in 2027. Much of our confidence has less to do with the BDC's earnings power but reflects management's strategy of keeping distributions well below its recurring earnings and gradually increasing the payout in a reliable fashion.

Where We Stand

October 11, 2023

Latest

Blessedly, Saratoga Investment (SAR) reports its quarterly results weeks ahead of all its peers, having chosen to close their quarter 30 days in advance of everybody else. This gives us plenty of time - a currency otherwise in short supply - to delve into the BDC's latest results and consider the way forward every quarter. Over at our sister publication - the BDC Reporter - we've just posted a summary of how the BDC performed in the 3 months ended in August 2023 versus our expectations and those of the analysts.

Long Story Short

In a nutshell, SAR performed in line with expectations where earnings, net asset value per share (NAVPS); portfolio growth, and credit were concerned. The fly in the ointment, though, is that an already troubled portfolio company - Pepper Palace - was placed on non-accrual and deeply discounted. A setback was in the cards but the amount of the unrealized write-down was far greater than our other sister publication - the BDC Credit Reporter - had expected. As a result, SAR's potential realized losses have increased and investment income is lower.

These Things Happen

None of the above is out of the ordinary. Even the best BDCs - and SAR has an excellent long-term track record where underwriting is concerned - trip up occasionally. Moreover, the BDC only has two significant underperformers in a 55 company portfolio, including Pepper Palace. Higher interest rates; incremental fee income and a modest recovery from Pepper Palace will offset investment income loss from the latest non-accrual. There is also the hope that the other non-accrual will ultimately return to performing status.

Reminder

However, the Pepper Palace situation is a reminder that a highly leveraged BDC like SAR is vulnerable to these sort of credit setbacks. If we get 3 or 4 Pepper Palaces at about the same point, the impact on earnings; debt to equity and - most of all - investor confidence, could be drastic. Thankfully, though, we are not aware of any new underperformers showing up on the radar - continuing a 2023 trend. Furthermore, management is well equipped to tackle troubled companies if the need arises. Also, down the road SAR has proven itself adept at realizing equity gains elsewhere in the portfolio, which might more than offset any losses in a handful of borrowers.

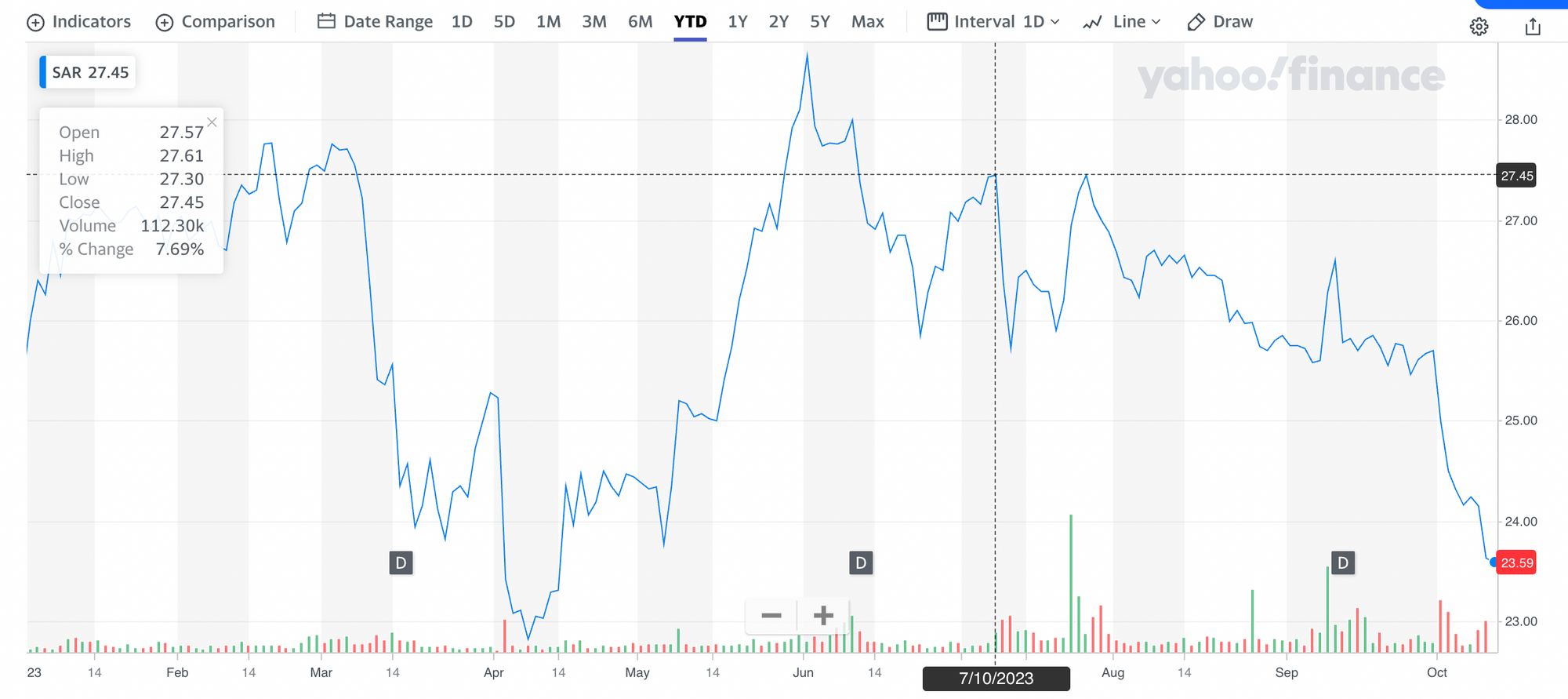

Reactive

However, Mr Market is unlikely to take the long-term view in a hypothetical credit downturn scenario. That's when the high leverage - notwithstanding that the debt is mostly fixed-rate, long term and covenant-lite - will weigh heavily. Already, investors have stepped back from SAR. As this YTD stock price chart, SAR peaked at $28.68 on June 1, 2023 and is currently priced at $23.38. That's a near (20%) decrease at a time when SAR is posting record EPS, AUM and distributions. In fact, SAR is close to its 2023 low, and trading below NAVPS.

Decision Time

Prospective investors have to decide for themselves whether SAR's price weakness is a temporary phase or a long-term trend. Anyone concerned that there will be many Pepper Palaces in the coming quarters would do well to stay away. Not only would such a phenomenon impact the BDC's financial metrics but also cause an outsized stock price retreat. SAR bulls, though, will see the current price - halfway between the 52 week high and low - as an opportunity to grab an above-average 12.1% yield and the prospect of multiple increases in the quarters ahead.

Going By The Numbers

The Expected Return Table continues to project SAR's annual payout will increase every year, reaching $3.20 per share, up from the current pace of $2.84 annualized. This is projected to occur even as we project that earnings will start to materially drop in 2025 as interest rates decline. Today SAR's earnings are running at $4.32 per share. Basing ourselves on management's projections in the 10-Q about the impact of rate decreases, EPS will drop to $3.80 by 2027. That's still a great deal more than the dividend payout in that year.

Valuation

Recommendation

Prior Updates:

August 14, 2023

End Of The Road?

Some say we are getting to the end of the Fed's interest rate hikes. Given that BDCs are overwhelmingly invested in floating-rate assets that augur peak earnings. We've had two years of record investment income, net investment income, and distributions, but all good things must come to an end. Or will they? If you go by the analyst earnings projections, most BDCs will see lower EPS in 2024 than in 2023. However, every BDC has a different backstory, and not all are headed for an earnings and distribution slump.

Example

Saratoga Investment (SAR) is a case in point. We'll cut to the chase and propose that both the adjusted earnings of the BDC and its payout should increase in the years ahead. We've been predicting for some time that SAR will pay out $2.9000 in 2023. That's above the $2.8100 reached in calendar 2022, and a record-breaking level. Our projection was validated today by SAR's calendar third quarter (fiscal second quarter) announcement of an increase in its quarterly dividend to $0.7100, following 1 cent increases in the prior two quarters. Chances seem very high that a $0.72 dividend will be coming in the fourth quarter, or $2.8200 for the year and within the 5% higher or lower range we consider IN-LINE with our estimate. (There may even be a top-up "special" dividend).

Down The Road

The BDC is much out earning its payout. In the quarter ended May 2023, Adjusted Net Investment Income Per Share (ANIIPS) was $1.0800. With the July 2023 0.25% rate increase; more assets under management and pretty much everything operating to plan in the portfolio those quarterly earnings still have room to run. Excess earnings will continue to pile into the $20mn of undistributed profits sitting in the BDC at the end of the last fiscal year, supporting management's dividend strategy of slow but steady dividend increases.

More

Not much of a factor right now but in the years ahead the economy will normalize as will the M&A market - currently in hiatus. When that happens, SAR should see many of its equity investments get realized at premium prices. For shareholders that means an additional source of taxable income, with the concomitant distributions involved. Obviously projecting what those gains might be and when is impossible but we cannot help but budget for some incremental value from that source. The BDC has a laudable historical track record of harvesting gains and there is no reason that will not happen again and benefit those shareholders sticking around for this opaque payday.

New Numbers

As a result - and even anticipating that recurring ANIIPS might start to drop from 2025 - we are projecting that SAR's total annual dividend payout will increase through 2027 to $3.200. (We'll add a 2028 projection when all 2023 dividends are in the bag). We're also assuming that the BDC's NAV Per Share will increase by 10% over its level at the end of 2022, as the many levers SAR has available to increase book value will more than offset any realized losses. There are only 3 BDCs in our coverage universe that we have that sort of NAV-growth confidence in.

Multiple Changes

On reflection - and because we're assuming future distributions will include realized capital gains - we're also being more "conservative" and bringing our Terminal Multiple that we use to calculate a Total Return down from 15.0x to 12.5x. That should provide a more realistic assessment of what the market might pay in 2027 for that level of payout. That brings the Target Price of SAR - currently trading at $26.90 - to $40.00. The nearly 50% increase in the BDC's price we're projecting will occur in an environment of lower rates, making the pro-forma 8.0% yield SAR would be paying in 2027 an attractive proposition. (Going by the annualized latest distribution and stock price, SAR currently yields 10.6%, but rates are very high). The pro-forma ROE in 2027 for shareholders (dividend to a projected NAVPS of $31.08 is "only" 10.2%, which seems reasonable to us.

Valuation

The Expected Return Model projects the total return will be 106% over 5 years or 21.1% per annum. By the way, according to Seeking Alpha, the BDC's total return over the last 5 years has come to 66%. Based on the 2024 projected dividend of $2.9800 per share, the SAR yield is 11.0%.

Back To Buy

As a result - and even though SAR is trading close to its 52-week high, we are switching our investment recommendation from HOLD to BUY. For investors willing to stomach the risks associated with a highly leveraged BDC, the potential return is appropriate. Nor is this a flash-in-the-pan BDC: the current management has been steering SAR - which under a different name and with a different manager almost imploded - in the right direction since the end of the Great Recession. If we're right and even though BDC prices have shot up of late, SAR represents a very intriguing investment prospect for the long term.

January 16, 2023

Pored Over

Last week, Saratoga Investment (SAR) reported its calendar IVQ results through the quarter that ended in November - the BDC's fiscal third quarter. SAR always gets more scrutiny from us than some other BDCs because of its outlier status on the calendar, reporting its results weeks before the BDC pack, most of whom won't be disclosing their performance till February. If you're interested in an in-depth review, check out our full-length review of all aspects of the BDC's performance in the BDC Reporter.

Sanguine

We've been bullish on SAR's earnings and dividend outlook since we started coverage in Best Ideas, as you'll see by reading the prior updates below from July, August, and October below. This is largely because the BDC has been a prime example of how we've needed to constantly revise our 5-year projections, Target Price, and valuation throughout 2022. Don't blame us but the unprecedented increase in the base borrowing rate by the Federal Reserve, whose impact has shown up in different ways for every BDC out there.

Wowza

In the case of SAR, in just 9 months, the average portfolio yield on its income-producing loans has increased by 23% - the biggest such move in the principal driver of earnings in its history. With virtually all the BDC's loan portfolio being floating rate (i.e. increasing income) and most of its debt fixed rate (i.e. not increasing cost), the result has been a spectacular jump in recurring net investment income. Just in this last quarter, adjusted net investment income per share jumped 31%!

To Each Their Own

We've been saying in the BDC Reporter that the entire BDC sector has been challenged by this abundance of sudden riches and had to adapt their dividend payout policies - which vary widely from BDC to BDC. SAR is no exception and has made our prognostication task all the harder by going from being uber-conservative in its dividend policy to uber-generous, as we'll discuss.

Once Again

All this is to prepare you - dear reader - for yet another (upward) change to the 5-year dividend projection, the Target Price, and the potential Total Return of SAR in the wake of its latest results.

Not Expected

Before we get to that, we'd also like to point out that the BDC surprised us by paying out 5 distributions in calendar 2022, increasing the year's payout from the $2.13 per share we calculated in October to $2.81, thanks to SAR's decision to greatly increase its quarterly dividend to $0.68, and set the record date in 2022. This does not impact our projections or valuation because our numbers begin now in 2023 and roll through to 2027, but still deserves a mention for anyone following closely.

Latest Numbers

In Line

Now to justify ourselves. The dividend projection is not unreasonable given that the current annualized dividend payout rate is already $2.72 and the annualized adjusted net investment income per share is $3.0800. Plus, SAR's management let us all know on their latest conference call that earnings would have been even higher if the latest Fed Funds rate had been applied throughout the November quarter. (Then there's the impact of even more rate increases coming in 2023). The analysts, too, have woken up to the almost certain higher earnings as you'll see in the Expected Return Table, increasing the projected EPS for FY 2024 to $2.92, from $2.61 previously.

Hold Back

In fact, we expect earnings to far exceed distributions in 2023 as the BDC is likely to squirrel away taxable earnings to support its dividend in future years when rates decrease. We're likely to see a mixture of regular and special distributions as management tries to keep the total annual payouts from fluctuating too much. Will we get the perfectly even $2.9000 a year we've projected? Probably not, but the $14.5 per share payout in aggregate is defensible.

Now For Something Completely Different

Understandably, the 15.0x Terminal multiple might seem aggressive. However, our long experience in the field suggests that this could yet occur even if the current multiple of price to projected payout is only 9.3x. Partly that reflects the current risk-off environment in a BDC sector trading (16%) below its April 2022 high. In SAR's case, the high multiple is also due to the prospective net realized gains that might be achieved. Even now 7.0% of the BDC's portfolio is invested in equity, whose value is $25mn higher than what was paid for. There are many companies in the SAR portfolio that might - in happier times - be sold for big gains, and which would supplement recurring earnings.

These Things Happen

The BDC has increased its NAV Per Share by 27% since the end of 2017 - more than any other - on the back of these sorts of gains. We've seen other lower middle market-focused BDCs like Main Street and Fidus Investment trade at unholy multiples of their distributions because of this capacity to generate earnings from both lending and investing. SAR is no different and that's why the seemingly absurd 15.0x multiple.

Aiming Lower

Model BDC

Although SAR's current stock price is hardly in the doldrums, trading 34% above its 52-week low; (4%) below its 52 high, and only (4%) below its net book value per share, we're a believer in our base scenario of a Target Price of $43.50. If we're wrong, and the multiple does not reach over 12.5x, that's still a first-rate return and good enough for us. We've been looking for a new addition to our Model Portfolio, and SAR fits the bill for a profitable long-term hold. We'll be adding SAR to the Model Portfolio on Tuesday.

October 6, 2022

Reassuring

SAR is always the first to report quarterly earnings given its books close 30 days before everyone else. Calendar IIIQ 2022 results - through August 2022 - were encouraging in a variety of ways, as mostly spelled out in our BDC Reporter article about the highlights of this period's conference call, which happened on October 5, 2022. To quickly summarize, Core Net Investment Income Per Share at $0.58, exceeded the prior quarter by 9%. NAV Per Share - a metric that one should expect to take a beating in these unsettled times - was off only (1.5%) and SAR managed to book a realized gain as well. Most importantly of all, we took a deep dive into the 50 company-plus portfolio and found very few trouble spots that might bring down income in the near term.

Not Paying

The only non-performing loan is to the travel software company Knowland Group. A resolution is being negotiated and - for a second quarter in a row - SAR suggested the debt could be returned to performing status but in Pay-In-Kind form. If so, that would be good for income but still leaves open whether the company will recover.

Limping Along

There are two other companies of concern: Pepper Palace - a specialty food retailer - and Zollege PBC - which helpsing people get employment in the dental sector. Long story short: both companies could yet turn around; income is being paid. If things don't work out - as happens - their failure would be more than offset by the much higher income on its way to SAR from higher rates. Just how "impactful" those rate increases could be is made clear in SAR's latest 10-Q, which says a 200 basis point increase in rates from the level in August could boost Net Investment Income Per Share by $1.16, a 57% jump over the annualized level as of August. Even a 100 basis points, adds $0.66 in EPS - 28% higher.

Double Boost

As management is quick to note - and with good reason - SAR also benefits from being financed almost completely by long-term, fixed-rate debt from the SBA or investors, with very few covenants. That makes SAR well insulated from any future market shocks that might cause other BDCs to default under their revolving loan agreements, and/or lose access to their liquidity. Nobody is invulnerable if things get bad enough - and the SBIC can require SAR's SBA-financed subsidiaries to not dividend up earnings to the parent if heavy losses are occurring in those vehicles. That seems highly unlikely from what we've seen in the past and currently.

Unmoved

That's a 13% increase but only assumes - if all earnings get paid out - a 4% increase over the current EPS running rate. Our friends in the analyst community are projecting EPS in FY 2024, which ends in February 2024, of $2.34. We admit to being more bullish, but the difference is not that material.

Valuation

Lower Scenario

Even in an alternative more modest scenario where we assume SAR's distribution does not increase for the next 5 years over its most recent level ($0.54/$2.16) and cut back the terminal multiple we've been using to 12.5x from 15.0x, SAR still offers up a 14.5% annual return over 5 years. Not shabby for standing still. Still, we have confidence that SAR is still going places.

August 29, 2022

Higher. At Long Last.

SAR has announced an increase in its regular distribution for its fiscal second quarter - which corresponds to the calendar third quarter of 2022 - to $0.54 This also might be the last such announcement for this calendar year, here in the dog days of summer.

After three quarters in a row of paying out $0.53, SAR has upped the distribution, as discussed in the BDC Reporter's Daily News Feed. For the year, this brings the total payout to $2.13. That's below our projection for the period of $2.18, as we were innocently expecting at the end of 2021 that SAR would continue in 2022 its trend of upping its distribution by 1 cent a share every quarter. Instead, management left its distribution level unchanged, causing our full-year estimate to be off by( 2%), which will hardly make a difference over a 5-year time frame.

Finito

Chances are SAR - which does not tend to pay "specials" - is done announcing distributions that have a 2022 ex-date. As a result, we've extended the projection to 2027. (The Expected Return Table is on a 5-year rolling schedule). Income projections in the table will use the 2023-2027 years, including the just added year as the terminal one to calculate the Terminal Price.

Difficult

Now we're facing the challenge that investors and analysts will be contending with for many quarters to come: projecting future earnings and dividends in an environment where the reference rate is constantly changing thanks to the Fed; months pass before SAR's borrowers have to pay a higher yield and a host of other factors will vary quarter to quarter. After all, SAR - and other BDCs - might see its investment income increase from higher rates and use the opportunity to reduce total investments. Or, the manager might retain more of the earnings given the availability of a surplus, which will complicate estimating distributions to come. Also, credit losses will occur - both normally and because of the strain of higher rates - which will erode the income benefit.

Starting Point

Because of its 10-Q, we do know, though, how much SAR estimates a 100 basis point or 200 basis point increase in the reference rate would do to boost net investment income (all the benefit would come from higher interest, there would be no higher interest expense due to all debt being fixed rate and SAR seems not to have accounted for higher incentive fees). For 100 basis points, we get a $7mn increase in NII or $0.57 per share, for 200 basis points $14mn, or $1.19 per share. Even the more modest rate increase would result in a huge benefit - and raise the yield from 7.7% to 8.7%.

Fair Enough

For our part, we expect a 200 basis point increase over the level at May 2022 - which was 1.0% - is a pretty safe bet, given that the current Fed Funds rate is 2.5%, and almost certainly going to be 3.0% (or higher) when the September revision kicks in. For SAR, the full effect might not be felt till late in the calendar year or in early 2023, but a tsunami of higher income is almost certainly on its way.

Swing Back

Admittedly by 2024, the Fed might bring rates down. We are assuming the reference rate will fall back to 2.0% in the longer run, giving SAR one year of potentially very large income increases and then a still higher-than-before yield (all things being equal).

Boiling Down

Translating all the above into annual dividend projections is more art than science. At the moment - and with a depressing lack of guidance from management - we are projecting 2023's distribution will jump to $2.41 - probably in a series of quarterly increases to the quarterly payout. From 2024 on, and through the annual payout is being pegged at $2.60. That's a big jump over the annualized $2.16 latest distribution of $0.54 - a 20% increase.

Undershooting?

Still, that's way below how high distributions could go on a pro-forma basis. We'll be the first to admit we've undershot the mark. These projections may need to be revised regularly - hopefully to the upside.

Eyes Wide Open

We know this sounds fantastical (way in excess of SAR's 73% total return over the last 5 years - using Seeking Alpha data), but we'll be seeing more and more of these upgrades to our BDC valuations as the months go by and rates start to rise. A built-in assumption is that the reference rate - once 0%-0.25% - will not be round-tripping in the years ahead, but will ultimately settle back to around 2.0% - well above the level of prior BDC "floors" and even where we were at the end of March 2022. This historic shift in the cost of capital should remake all BDCs' ROEs and ROAs well into the decade.

July 8, 2022

Saratoga Investment (SAR) has in the last couple of days released its quarterly earnings through May 2022; filed a 10-Q; published a detailed Investment Presentation and held its periodic conference call. Over in the BDC Reporter, we wrote an article in advance of earnings and another just after - comparing what we anticipated the results might look like and what actually transpired. Likewise, in the BDC Credit Reporter, we've already written reports on two underperforming companies, including SAR's just announced one and only non-accrual, out of 45 companies and two investment vehicles. In our database, we've plugged in all the latest numbers and updated the Investor Tools in the BDC Reporter: BDC NAV Change Table and the BDC Credit Table.

Targeted

In other words, we've done our homework - made easier because SAR reports results nearly a month before any other BDC. After all that, we've reviewed the 5-year dividend and price target projections which guides our buying decisions for every public BDC we track, and changed absolutely nothing.

Nothing To Write Home About

Admittedly, the mid-sized BDC - which has just less than $1.0bn in portfolio assets - did not have a particularly good calendar second quarter/fiscal first quarter of 2022. As noted, there was a new non-accrual where there had been none before, resulting in lost interest income, and the possibility of a material net loss one day. Another portfolio company went from performing to underperforming, albeit still paying interest. Then there were unrealized write-downs - due to difficult market conditions - for both SAR's solitary CLO investment and its recently launched off-balance sheet joint venture. Earnings more or less met the analysts' expectations, but only because the advisor did not earn an incentive fee, and actually credited back compensation previously charged. Leverage - both on a regulatory and GAAP basis - closed the quarter at high levels as the BDC bulked up on new portfolio investments. Finally, after quarter after quarter of increasing net book value per share, SAR recognized a (2.2%) drop in this key - if overused - metric.

Outlook

Nonetheless, we don't see any current threat to the BDC's earnings and projected distributions. That's partly due to the full-quarter impact of a bigger income-generating portfolio going forward and the increase in rates that is beginning. The BDC projects Net Investment Income Per Share (NIIPS) will increase by $0.57 annually on just a 100 basis points increase in the reference rate, and we may get much more than that. No wonder the analyst consensus for FY 2024 is for NIIPS of $2.31, well above our dividend projection.

We do worry about SAR's high leverage levels, but are consoling ourselves with the fact that virtually all the debt is medium to long-term; virtually covenant-free and with a fixed yield. Likewise, SAR has a history of quality credit underwriting and should be able to withstand the recessionary conditions ahead, even if asset values drop for a period. The CLO has been through the Great Recession and survived and should do so again.

Not The Best

Unfortunately, and despite a drop in SAR's price following the IIQ 2022 results, the projected return in our model - while high at 16.5% per annum over the next half-decade - is still much lower than what we could achieve elsewhere. The BDC sector price slump that began April 21, 2022, is causing many long-term returns to look very juicy. There are multiple BDCs that promise annual returns for the long-term investor in excess of 20%, or even 30%. As a result, SAR remains a good buy, but there are far better alternatives elsewhere in our coverage universe. That could change if SAR - trading close to its 52-week low - drops further in price.