BDC Update: Ares Capital

February 8, 2024

Fine Tuning

Now that Ares Capital (ARCC) has reported IVQ 2023 results, we've taken a fresh look at the Expected Return model for the market-leading BDC. We're not making any changes to our earnings projections for 2024-2028 or to the multiple we use to calculate a Target Price. The only change we've made is to reduce the expected annual dividend payout in 2024 and 2025 to $1.92, or $0.48 per quarter.

Too Sanguine

We've been over-optimistic for the last year about how much of ARCC's earnings management is willing to distribute. We admitted as much the last time we wrote an update on January 3, 2024 - see below. On the most recent conference call, we were reminded again that ARCC's "philosophy" is to deliberately under-distribute to maintain an unchanged quarterly distribution for the long term. If there was going to be an increase in the regular distribution, we'd have heard by now. Instead, ARCC has paid or announced the same $0.48 distribution for 6 quarters in a row. With everyone expecting interest rates to begin dropping in the second half of 2024, it's unlikely ARCC would choose this year to up its quarterly commitment. The BDC even seems to be able to avoid making top-off "specials". None were paid in 2023 after 4 were paid in 2022.

New Number

So, we're projecting that ARCC will seek to maintain its annual payout at $1.92 through 2028. Even as rates fall and earnings drop, the BDC is likely to attempt to keep its dividend "stable". At the current share price of $20.0, the yield on offer is 9.6%.

Valuation

Recommendation

January 2, 2024

Recent Performance

Of course, 2023 is not over as far as BDC's financial performance is concerned but with 9 months officially in the bag, the picture is relatively straightforward. Let's start with the number one public BDC by assets - Ares Capital (ARCC). With $1.74 per share in Core EPS (a favorite non-GAAP metric of both the BDC and the analysts), and $0.60 projected in the IVQ, the full-year result is likely to be $2.34 per share. That's much better - 16% in fact - than the $2.02 per share in Core EPS in both 2021 and 2022. We're pretty sure this must be the high point to date for this key metric in the BDC's long and august history.

Pay Less

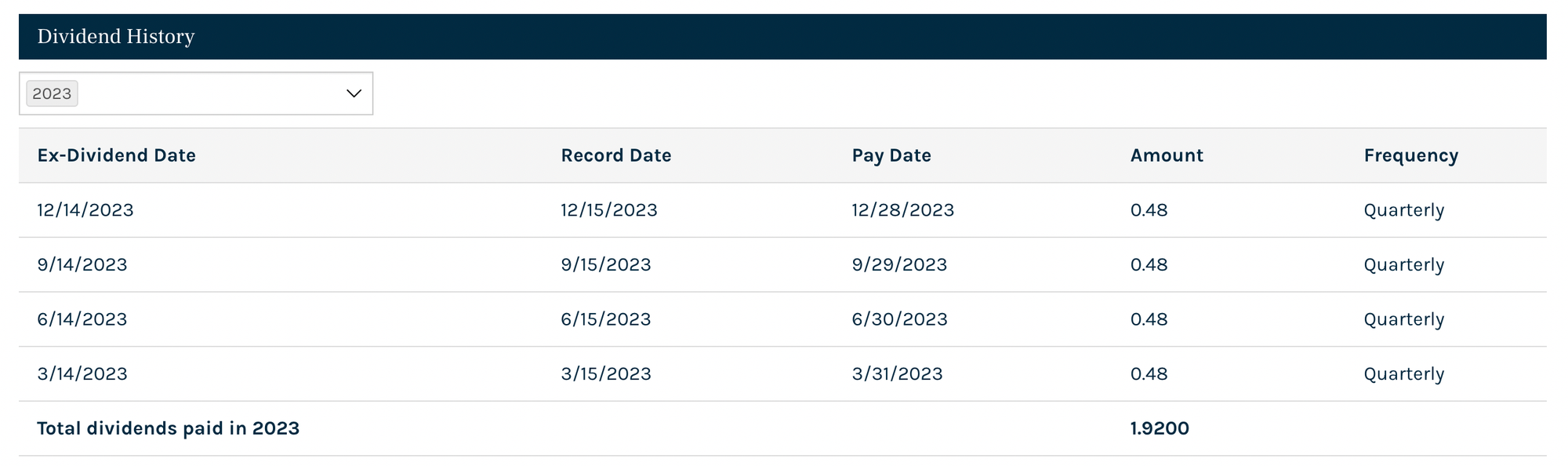

The 2023 dividend picture is a little less rosy. The BDC has announced the following distributions, copied from its website:

The $1.9200 per share is likely as good as it's going to get, eclipsing 2022's $1.8700 and 2021's $1.6200 per share, a 3% one-year increase and a more impressive 19% over two years. We checked the BDC's annual dividend table from inception and 2023 posted the highest payout ever. Still, we had expected an even better harvest: $2.3000 per share on unfounded expectations that the BDC would be forced by BDC rules to cough up more of prior years' undistributed earnings. We've got egg on our face, but 2023 was still a memorable year even if management chose to tuck nearly a fifth of all core earnings under the mattress. ARCC will say they are being conservative, we say they're being miserly. However, there's little to complain about as those retained earnings can be put to profitable use in the most lender-friendly environment in a generation.

Booking Value

As to that other metric that every investor follows - net asset value per share (NAVPS) - ARCC is up 3.2% in the first 9 months of 2023 and that forward progress should continue in the final quarter. Still, don't clap too hard because most of that higher net book value is just your undistributed earnings. ARCC has had a tough year where other components of the lower half of the balance sheet are concerned. Net Realized losses of ($207mn) through 9 months are at their highest level in years, and the BDC seems likely to lose more money this way than during our last real recession year of 2020. Through nine months, shareholders have endured realized losses greater than 20% of all Net Investment Income generated. It's a subject that management glosses over on their conference calls, but the numbers speak for themselves.

Return

At this stage, with ARCC trading at $20.03 a share - very close to its 52-week high of $20.21 and a 5% premium to net book value, its return on equity on a book basis is a hearty 12.3%. By contrast, in 2021, that same ROE was 10.7% before interest rates began their ascent.

Outlook

So what does 2024 promise? We are generally bullish on the fundamentals- probably more than the analysts. On the earnings front, the BDC has access to all those retained earnings and a great deal of unused investing capacity as the BDC has increased its share count by 11% over the last 9 months and brought its net debt-to-equity down from 1.26x at the end of 2022 to just 1.03x at the end of September 2023. ARCC's AUM has barely increased in 2023 but, on paper, the BDC could add $2.4bn in investments and still meet its 1.25x debt-to-equity target - an 11% jump. Will ARCC use up some or most of its firepower in 2024? It's hard to say and will depend on demand for debt which might pop if interest rates do drop. There's many a PE group waiting to sell a portfolio company and many another ready to buy if the economics make sense.

Key Metrics

Anyway, BDC Best Ideas projects that the famous Core EPS will peak at $2.37, slightly over the 2023 estimate and better than what the analyst consensus is: $2.33 per share. Once again, we are bullish about the total dividend payout to be expected. We're estimating $2.1600 a share because of the BDC tax rules but a more conservative approach might be $1.92-$2.00 a share - including some sort of special. Again, we expect NAVPS will be flat to slightly higher. The analysis undertaken at BDC Credit Reporter indicates there are further unrealized and realized losses coming from the $21bn portfolio, and might match or exceed 2023's numbers. However, by retaining earnings and issuing stock at a premium to book, ARCC should maintain a stable NAVPS. Over the past 5 years, the BDC's NAVPS has increased an impressive 11% so this is not an outlandish projection.

Pretty Penny

Unfortunately for bargain hunters, ARCC - as usual - is not cheap. The projected 2024 price to projected earnings (using our estimate) is 8.5x and going with a mid-range -but still record-breaking - 2024 dividend of $2.oo, the yield today is 10.0%. That's nice, but well below the BDC average. Our Target Price over the next 5 years is for ARCC to reach $24.00 - a 20% increase. Just to match its all-time high of $22.28, ARCC will need to increase 11% in price. That's not an implausible level to reach in the current market and something we could see in 2024. As we've been noting every week since late October 2023 in the BDC Reporter, the sector is in rally mode and who's to say when the music stops?

Our View

November 22, 2023

Kept Busy

Since our last Ares Capital (ARCC) update, we've read and reviewed the IIIQ 2023 results which were published on October 24, 2023, and undertaken a full credit review - published in the BDC Reporter. This followed an update of all the underperforming companies in the portfolio conducted by the BDC Credit Reporter.

Nothing Special

The IIIQ 2023 earnings performance was relatively tame, with "Core EPS" increasing only $0.01 to $0.59. Likewise, the IVQ 2023 dividend was the same as in the quarter before. We'd hoped for a "special" dividend to be announced which would bring the total 2023 payout closer to the $2.33 of EPS expected in 2023, but that hasn't transpired. There's still a small chance some sort of top-up will be made but we've amended the Expected Return Table dividend projection to $1.92, from $2.30 previously.

Untouched

However, we are still projecting that ARCC will increase its earnings and distribution in 2024. The former will go on to gradually decrease in 2025-2028 while the latter will drop back to the current $1.92 per share level. By 2028, our model suggests ARCC's Core EPS will be $2.10, modestly higher than the $2.02 achieved in 2021 before rates began to rise. We're expecting the BDC will be able to maintain its existing $1.92 distribution level.

Valuation

Recommendation

October 15, 2023

Changes

Our Expected Return model is evolving. We're now projecting earnings five years out, rather than a maximum of two as before. Nor are we just parroting what the analysts expect but coming up with our own numbers. Moreover, we are also projecting how a BDC's Net Asset Value Per Share (NAVPS) will perform over the long term. That, in turn, determines what sort of terminal multiple we use to set the target price for a stock. The better the NAVPS performance, the higher the multiple. Investors pay up for BDCs that can maintain or increase their NAVPS.

Hard Look

Finally, we're trying hard to estimate the impact on earnings and distributions from the change in Fed-driven short-term rates. Basically, we expect the Fed Funds rate - and thus SOFR - to remain high through mid-2024, before declining (1%) a year over the next 3 years, flattening out at roughly 2.5%. Like everyone else, we're just guessing, but our view is not very different from what the Fed members are "plotting" or what Wall Street.

Recast

As a result, we see ARCC's earnings reaching $2.33 a share this year and peaking at $2.37 in 2024 (a more aggressive stance than the analyst consensus). However, from 2025 through 2027, earnings should gradually decrease ending at $2.10. (We'll add 2028 to the model when this year's payout tally is known). On the dividend side, we're still expecting a payout of $2.30 this year, even though the pace through the IIIQ 2023 is $1.92. Rightly or wrongly, we expect a top-off "special" before year-end. In 2024 the payout is expected to drop to $2.16 - as earnings are expected to greatly exceed dividends. Only in 2026-2027 does the annual payout level out at $1.92 in each year. Based on our belief that NAVPS will be unchanged, the expected return on equity is 10.4%.

Valuation

Recommendation

February 7, 2023

Short & To The Point

We've just reviewed Ares Capital's (ARCC) IVQ 2022 earnings press release, and Investor Presentation and listened to the conference call and are glad to report our naked optimism about the BDC's earnings potential; credit quality, and dividend-paying capacity - reflected in our earlier updates - is being borne out.

Not Yet

Admittedly, management did not increase the regular dividend in IQ 2023 nor announced any special payout as yet. However, the amount of undistributed taxable income is huge - 2.5x its quarterly distribution - and will eventually find its way into shareholders' pockets. In the interim, conditions are ideal for leaving those funds to make profits in a lender-friendly environment.

Standing Firm

October 27, 2022

Ares Capital has posted excellent IIIQ 2022 results and the future is even brighter. We've had to recast our projections skyward.

Wowza

Ares Capital (ARCC) has kicked off IIIQ 2022 BDC earnings season with a bang. Core EPS was $0.50, higher than consensus of $0.49, and better than the quarter before at $0.46. Even more impressively the "regular" quarterly distribution was increased by 12% to $0.48. This is the third increase in 2022. Along with the "specials" the BDC has been paying out, ARCC's total payout to shareholders in this calendar year to $1.8700. All this, and much more, was discussed in the BDC Reporter when we annotated the conference call of the BDC.

Settled

Given that management proposes to discuss what's next in dividend terms when IVQ 2022 results are published in early 2023, that suggests $1.8700 is the final number for this year. That's 15% higher than in 2021. Check out the Expected Return Table which shows annual distributions for ARCC - and every other BDC - from 2019 on.

Looking Forward

By no means is ARCC done with the earnings and dividend increases, putting pressure on us to come up with new estimates for the years ahead through 2027. Let's explain our maths: ARCC is achieving Core EPS of $0.50 quarterly ($2.00 annualized) but admitted the number would have been $0.54 if the impact of higher rates had occurred throughout the whole period.

Moreover, for every 100 basis point increase in the Fed Funds rate after September, ARCC expects to earn an additional $0.27 per share annually. We are assuming a 150 basis point increase by early 2023, or another $0.40. (Not figured in is any gain from higher spreads on new loans, nor any additional interest expense as small amounts of fixed rate debt get refinanced). On paper that would take ARCC's earnings per share at some pro-forma date in the future to $2.56.

Bonus

Then there's what we estimate might be as much as $1.50 per share in undistributed taxable income, to be gradually leaked out to shareholders as per the BDC's parsimonious strategy. For these purposes, we expect ARCC will pay out 50% of this pile of income every year for the next 5 years.

Adding Up

The analyst consensus for EPS in 2023 is now $2.16, which is probably low. We project EPS will be at least $2.30. Add to that the assumed undistributed income "special" of $0.15, and you've got a total payout of $2.4500. That's 31% higher than the already high 2022 level! From 2024 on, we're assuming EPS drops back to the adjusted IIIQ 2022 level, or $2.1600. We add the $0.15 special and we're at $2.3100, down from the 2023 heights, but still 24% above the 2022 level.

Adjusting

We know the numbers seem fantastical. It's partly because we've been living in a zero interest rate, very low inflation, environment for so many years. We also admit there probably should be a deduction for higher debt loss costs. We've assumed 5% of income-producing assets will be written off, resulting in ($0.15) per share in EPS losses per year. We've applied this from 2023 through 2027, bringing the projection to $2.3000 in 2023 and $2.1600 from 2024-2027. The Expected Return Table has been updated accordingly.

High Expectations

Keeping Keeping On

This BDC has been a perennial winner - managing to increase its NAV Per Share over a long history - and leading the industry in a host of ways. Our projections suggest the next 5 years should continue this tradition for investors.

Credit Afterword

By the way, we are spending a great deal of time poring over all underperforming companies in the portfolio - many updated in our sister publication the BDC Credit Reporter. Our conclusion so far: ARCC is not immune to making some material credit mistakes, but in as large and "granular" portfolios as theirs, the impact is barely felt. Moreover, its above-average level of equity stakes means realized gains in the future - when the world settles down - may end up offsetting some - or all - the loans that are written off. That means our deductions for income lost to bad debt may be overly conservative. We shall see.

August 23, 2022

Getting To Grips

This is a delayed update for Ares Capital (SARCC) following the IIQ 2022 earnings conference call which we annotated. In a nutshell, the BDC made clear what most observers had already intimated: earnings and dividends are likely to move up higher than we'd previously anticipated. The cause: higher reference rates thanks to the Fed and - to a much lesser degree - higher spreads on new loans.

Ever Higher

The latest analyst consensus is for ARCC to achieve Net Investment Income Per Share (NIIPS or EPS) of $1.86 in 2022 and $2.04 in 2023. Just 90 days ago, the projection was for $1.80 and $1.91 respectively. That's a 3% increase in 2022 and 7% in 2024.

Ka-Ching

ARCC itself has already reacted - especially as the undistributed taxable earnings the BDC has accumulated have become embarrassingly high at $1.44 per share - by increasing its regular distribution for the IIIQ 2022 to $0.43, along with a previously announced $0.03 "special". We now project the total payout for this year will be $1.84 ($1.80 previously), with $1.36 already in the bag. For 2023, we are projecting distributions jump to $1.92. That would be a new all-time annual record but still assumes EPS to dividend coverage of 106%.

Same Old

We project the same distribution of $1.92 thereafter through 2026 as slightly lower rates and potential credit losses, not to mention a BDC at maximum leverage keeps a lid on profits and payouts. No change was made in our terminal multiple of 14.0x, keeping the Target Price for ARCC at $26.88. The principal change is that the yield on ARCC's stock - trading at $20.00 at the open - is now 9.6%, based on our 2023 payout prediction.

Bottom Line

Our 5-year model, using that $20.00 price, shows ARCC generating a "total return" of 82%, or 16.4% per annum. That's similar to the Seeking Alpha calculated 5-year total historic return of 98%. Given that ARCC is trading at a premium to net book value per share and not far from its 52-week high of $23.00, this projected return seems high but reflects how the BDC market has not yet fully adjusted to the prospect of higher earnings.

February 9, 2022: Bravo to market leader Ares Capital (ARCC), which reported both record earnings for 2021 and its highest-ever NAV Per Share. In the BDC Reporter, we annotated the latest conference call transcript, which discussed those developments and much more.

Higher Dividend Announced

As important for our purposes, ARCC made an important dividend change: raising the quarterly payout to $0.42 from $0.41 (increased midway just last year) and adding $0.12 per share in special distributions, to be paid out every 3 months through this year. At a stroke, the annual dividend payout for 2022 has been set at $1.80, even if no further addition is made later in the year. That's higher than the $1.62 paid out in 2021 and the $1.60 in 2020 and 2019. It's also higher than we had anticipated in our model, even though we'd been predicting an increase to $0.42 quarterly in the last two quarters of this year, for a total annual payout of $1.66.

More Increases Ahead?

With this latest development - and given that ARCC's earnings are trending so high - we've increased our 5-year projection for distributions. After $1.80 in 2022, we are penciling in a $0.02 annual increase for every year through 2026, ending at $1.88. Given that the analysts - who always seem to aim too low when making their earnings predictions where ARCC is concerned - are projecting Core EPS in 2022 of just $1.85, our projection seems "conservative".

Promising

Admittedly, ARCC has just come off an exceptional year of investment activity which management was downplaying the likelihood of repeating. Furthermore, debt to equity at year-end (before the recent secondary) is very close to target leverage, and pressure on spreads continues to be a problem. Nonetheless, the way forward looks promising for ARCC, both in terms of recurring income but also for booking realized gains along the way.

Same As Before

We are maintaining our exit multiple at 14.00x the year 5 distribution as before. (That's not the highest multiple in the BDC sector and an argument could be made that ARCC deserves an even higher number). Today the BDC traded at a 52-week high and 12.8x its 2022 distribution. We expect that could go higher given the positive outlook for the business and with the prospect of a 10% or greater increase in the distribution should LIBOR increase by 2.00% or more by 2023.

Our target price has been increased to $26.88, 20% above the closing price for the stock on Wednesday, February 9, 2022, of $22.32. According to our model, the likely 5-year return on those new metrics is 59%, or 11.8% per annum. That's below our Best Ideas threshold, which typically involves a total gain of 75% or more. Still, for a BDC that has just been at a 52-week high that's a superior return and promises an immediate "safe" yield of 8.1%. We may not be buying more shares in ARCC at this elevated price and after this "feel-good" announcement, but we won't be selling off what we already own with such a significant price appreciation possibility and a decent yield from a tried and true BDC veteran.

January 16, 2022: As covered in the BDC Reporter, Ares Capital (ARCC) reached a new 52-week high of $22.35, just before issuing new shares at a price of $21.40- also a record price. Of course, there was probably some "juicing" of ARCC's price in advance of the secondary, but the secondary price was 13.2x the $1.62 in distributions the BDC paid out in 2021, and 13.0x the annualized running rate of the latest $0.41 dividend. This is one of our favorite valuation metrics, which we use to project the terminal multiple to be used in our 5-year financial model.

Higher Terminal

We've decided to up ARCC's terminal multiple to 14.0x, from 13.25x, reflecting both the market's growing appreciation of the BDC and the increasing value of the ARCC franchise in large-cap LBO lending. The BDC has several well-heeled rivals including BXSL, ORCC, and FSK, but none match ARCC's historical track record, regularly increasing NAV Per Share, well-constructed financing, and access to the major sponsor groups.

Elevated Target

As a result, our Target Price has increased from $23.06 to $24.36, or 6%. With ARCC trading - just a few days after the secondary and two months away from the next distribution - at $21.44, we'll need to see a 14% price increase to reach the Target Price. In the model, we also assume regular dividend increases of $0.02 per annum over 5 years, bringing the running rate annual distribution from $1.64 currently to $1.74 in 2026. Management jealously retains more of its earnings than most BDCs - partly to fund the higher distribution liability brought on by secondaries such as the latest one - and partly out of an excess of caution and to be able to boast about higher NAV Per Share. Still, we think BDC tax rules on distributions will cause the dividend to be upped, even if modestly.

Analyst View

By the way, the analyst earnings consensus (Core EPS - to use the number ARCC prefers) is for $1.84 in 2022, well above the dividend we are projecting. Moreover, ARCC is already estimating that IVQ 2021 Core EPS will be in the range of $0.56 - $0.58. Annualize that midpoint and ARCC's pro-forma current Core EPS is $2.28...For the moment - and before we get into any recalculations if short-term interest rates shoot up more than 1.0% - we are confident in our 5-year outlook.