BDC Market Snapshot: Week Ended November 4, 2022

Similar

Although BDC sector prices increased for another week, with the S&P BDC Index up 2.2% and 29 stocks increasing in price (out of 43) the investing outlook was largely unchanged. The number of BDCs which we project will earn a "total return" of 20% or more per annum over 5 years fell to 20 from 21. Moreover, there are still 16 in the 15%-20% annual return box - a category in the past that would have been considered a juicy return by itself.

Many Changes

The main reason returns are not much affected by higher prices is that BDC earnings season was in full flow last week, with 18 different players reporting. Almost every BDC had excellent financial results to boast of and there were many, many increases announced in "regular" and "special" dividends. Moreover - and in a first for the BDC sector - BDCs lined up to promise IVQ 2022 and 2023 earnings and distributions were headed even higher.

Payout Challenges

Many BDCs found themselves amending their dividend policies to signal how future earnings might be offered to shareholders. As an example of what we're talking about, here's ORCC's infernally complicated new strategy, as explained on the BDC's earnings conference call:

Get that ?

Keeping Busy

We found ourselves updating the Expected Return Table all week, and we have more work yet to do. In many cases, calendar 2022 distributions are now complete, and there are first quarter 2023 regular payouts already divulged. More importantly, the unusually high level of "guidance" - using the term in the broadest sense - from BDC managers about future EPS and distributions caused us to increase projections for 2023 and beyond for many players. This boosted ultimate "total returns" and dividend yields and explains why there are still so many outstanding long term returns, even as the S&P BDC Index sits 14.,3% above its 52 week and 2022 YTD low.

Biggest

By market segment, there are three BDCs involved in what we call Upper Middle Market (UMM) lending - loans to very large borrowers - in the 20% plus club: ARCC, ORCC and FSK. That last BDC, though, has not yet reported results and may be in for a re-rating.

Number One

Market leader ARCC offers a 22.5% annual return, partly thanks to higher expected earnings and distributions. Yet, our terminal earnings projection is for $2.16 per share in 2027, only equal to the BDC's current earnings as adjusted for a full quarter of higher rates in the IIIQ 2022. We expect income - and total distributions - will go up and then come down, but still remain above the 2021 EPS level of $1.6200 - a 33% "permanent" increase.

Under-Appreciated

The bigger opportunity in ARCC - and so many of the BDCs - is the ultimate price increase. Admittedly ARCC is trading at a premium to net book value per share of (4%) at its Friday close of $19.39. Still, that's (16%) below its 52 week and all-time high price of earlier in the 2022 when the mood was better. Our target price is $30.24, which must seem impossibly far away but represents a 14.0x multiple of its terminal distribution, in line with prior multiples calculated in this way. Understandably investors are wary and ARCC - probably the best long term performer in this segment of the BDC market which accounts for half of all investment assets - is only trading at 8.7x 2023 EPS. At its lowest point this year ARCC traded at $16.53 and that was only 5 weeks ago. The current yield is 11.3%.

Too Low ?

ORCC - often seeming to play Avis to ARCC's Hertz (does anyone still get the reference ?) - had an impressive IIIQ 2022 and promised much more besides. We've increased the payouts expected through 2027 and the Target Price is $17.64 versus the Friday closing of $12.78 - a 38% prospective increase. The 2023 PE here is only 8.0x. Frankly, though, we may have undershot what distributions will be and may have to take a second look once BDC earnings season is over.

More Besides

We'll have more to say on FSK - which carries the biggest burden of underperforming assets - after IIIQ earnings are reported and will be interested to see where BXSL stands, whose annual return projected is "only" 17.3%, but is that due to our having too low a set of dividend expectations ?

In This Together

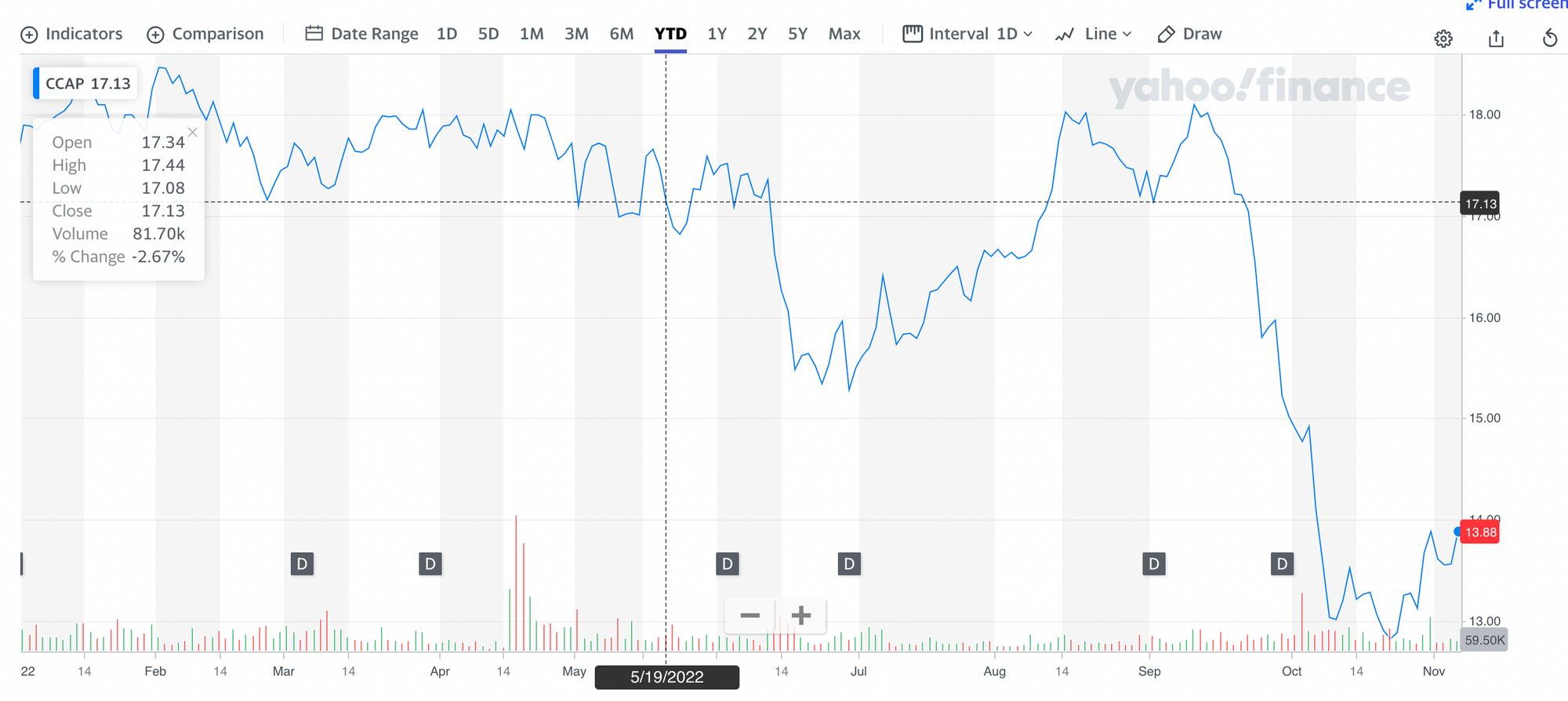

All the other market segments that BDCs lend into - lower middle market, middle market, venture and hybrid - are represented in the 20% annual return group. A number have not yet reported and - like most investors at the moment - there's little lost in waiting to see how the cards get turned up in the days ahead. We're intrigued by CCAP - playing in the MM segment - which has been mercilessly punished for offering decent terms to First Eagle Alternative's (FCRD) shareholders as part of the intended merger. Just look at this YTD price chart:

Extreme Prejudice

CCAP at $13.88 on Friday is (24%) below its highest price in early September, and trading at a (33%) discount to net book value. Really ? The 2023 PE - which may not be reliable as we don't know how much analysts have factored in the acquisition - is 7.3x.

Art Of The Possible

We are only using a 13.0x multiple of the 2026 dividend - in line with historic performance - which gives a Target Price of $23.40, a 69% upside. We know it sounds impossible that any BDC might increase so much in price but when you add in prospective higher earnings and much depressed investor sentiment that's what happens. Just over a year ago CCAP's stock price - perhaps a little goosed by its underwriters - was trading close to $22 a share. The long term investor knows - even if they might differ with the specifics of our projections - that "animal spirits" will not remain muted for ever. We've got twenty years of BDC price history as proof of the pudding.

Daring

The most intriguing opportunity of all - and a potential Best Idea once we've done all our research - is much battered TRIN. This newly public venture debt lender/investor has tripped itself up with several portfolio investments in crypto "miners" - an industry segment we still don't understand even after much frantic reading to catch up. Top of the problem list is Core Scientific, which seems almost certainly headed into Chapter 11 - see the recent BDC Credit Reporter article.

Much Damage

We learned a great deal more on TRIN's conference call, as well as news of another, non crypto, troubled credit. More research needs to be done, but in the interim TRIN's stock - despite higher earnings and only a modest drop in IIIQ 2022 NAV Per Share - has fallen out of bed. Here is the 2022 YTD stock chart. Warning: not advised for anyone with weak stomachs:

Incredible

TRIN has dropped (42%) since March, including reaching a 52 week low last week of $10.42, but is now at $11.70. We all know the markets often over-react in either direction. That may well be the case for TRIN, trading at 5.8x 2023 earnings. The yield is (cough, cough): 20.5% !

Learning Experience

Admittedly by the time we've done our ponderous research into a portfolio that is very new to us, TRIN may be trading higher but we're not into catching falling knives without some advance preparation. We'll also be very interested over time in comparing the BDC's comments on its conference call about its credit travails with what occurs in the future to get an impression of how forthright or on top of things the management proves to be.

More Of Same ?

Anyway, we're looking forward to week three of BDC earnings season (although week one was limited to ARCC) and expect there will be many more adjustments to BDC earnings and dividend outlooks. After all, we are in the most prolific period we can remember in twenty years in this regard. These reassessments - barring some huge increase in BDC stock prices - should continue to keep many bargains available for BDC long term investors willing to look beyond the ever growing likelihood of a recession coming in 2023. All our projections factor in prospective recession losses, but the severity of what might be headed this way is very hard to gauge.