BDC Market Snapshot: Week Ended May 19, 2023

Apologies

BDC earnings season made it impossible to maintain the weekly schedule of our Market Snapshots. May-to-date has been a whirlwind of BDC results landing. For our sins, we read every press release, quarterly filing, investment presentation, and conference call transcript. In our internal database, we transpose all the key data necessary for financial analysis, which keeps us hopelessly busy 4 times a year as we input and assess all those latest numbers. Thankfully, we're now caught up and back to our regular programming.

What We Do

In Best Ideas itself, we update any changes to analyst projections for 2023 & 2024 and compare actual dividends announced against our projections. You'll see in the Notes section of the Expected Return Table what the latest payout announcement amounted to and whether or not that has caused us to reassess our own projections. More on that below.

Holding Back

Everybody but Capital Southwest (CSWC) has reported IQ 2023 results. Most BDC dividends announced remained in line with our expectations. However, there are several instances where the latest quarterly dividend (typically for the second quarter) is well behind the level needed to meet our full-year forecast. (We don't bother you with quarterly estimates). That's largely because many BDCs are retaining a greater portion of earnings than ever before, rather than paying them out to shareholders. The remarkable record this quarter of 21 BDCs reporting an increase in NAV Per Share is largely built on these high retentions.

Dividend Delayed

We understand why many managers are adopting this approach (even while paying themselves full freight where fees are concerned). It's about the uncertain environment and also because most BDCs are leveraged up to their target limits, making every dollar of capital especially valuable. Given the BDC rules, these earnings will have to be paid out anyway - some of them shortly and some a little later. As a result, we're expecting a slew of "special" dividends in the last quarter of the year to supplement regular distributions and bring the final payout tally up to our projections.

Case In Point

Let's use Ares Capital (ARCC) - the largest BDC and one of the most parsimonious with its shareholders - as an example. In IQ 2023, Core Earnings Per Share ("Core EPS") was $0.57, but the BDC paid out a second-quarter regular distribution of only $0.48, or 84% of what was earned. Furthermore, management admitted to having at year-end 2022 $650 million of undistributed taxable income, or approximately $1.19 per share.

This 2022 spillover level is nearly 2.5x greater than our current regular quarterly dividend rate.

Even More

Presumably, that spillover has grown even higher following the IQ 2023's under-distribution and the analyst consensus that Core EPS will reach $2.30 this year, covering the dividend run rate by 20%. Even though ARCC has "only" paid out $0.96 through the half year, we're still comfortable with our full-year estimate of $2.30 - which would require $0.38 per share "special" if management does not change the regular distribution going forward. Unfortunately, we won't get confirmation till late in the year.

Deserves Better

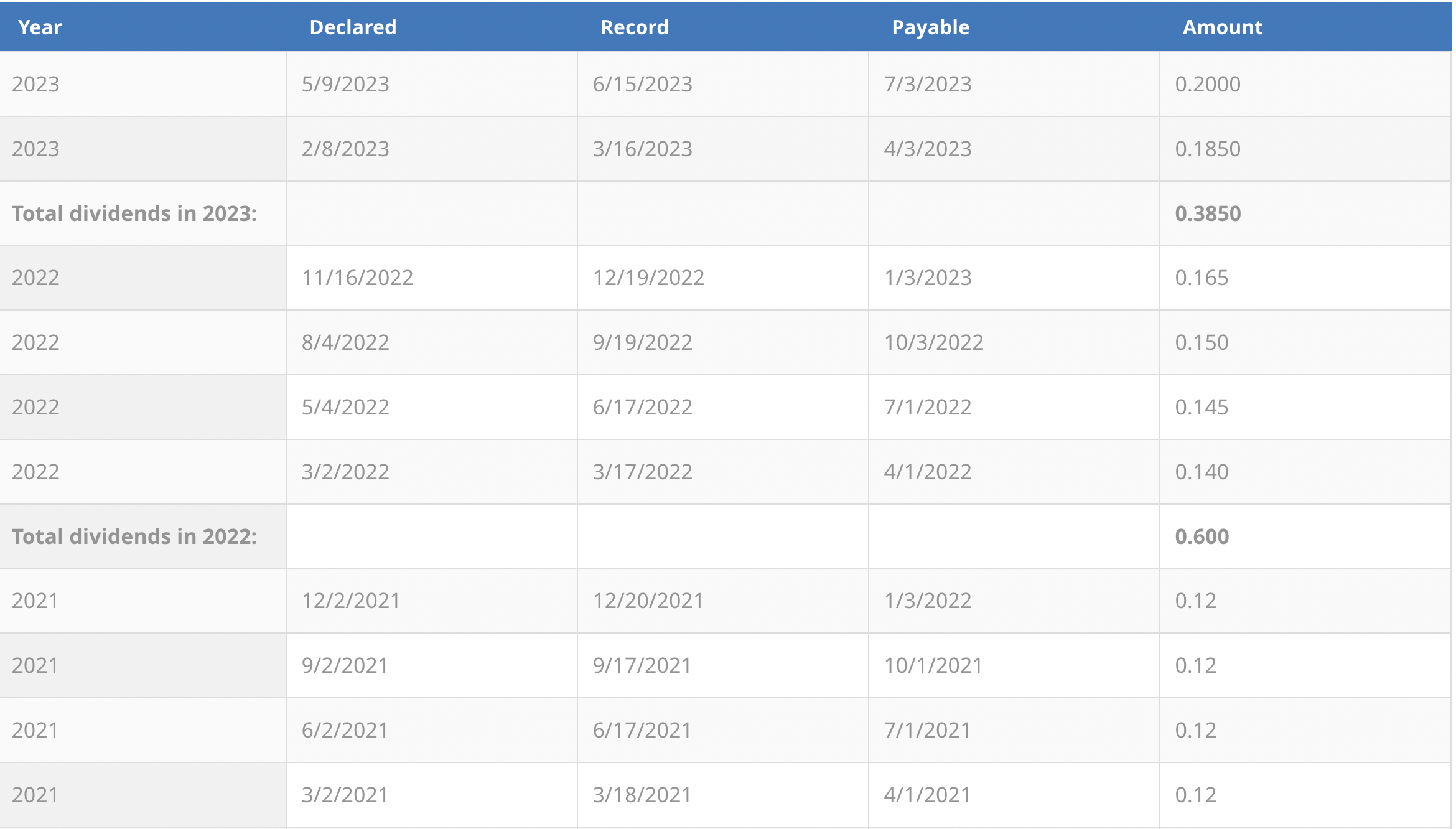

With all that said, there is one BDC that is due for an Update and an upward revision of our dividend forecast - PennantPark Investment (PNNT). As this table below shows, PNNT has been constantly increasing its payout of late, following nearly two years of paying a regular distribution of $0.12 per share:

Relentless

After 6 PNNT dividend increases in a row, we recognize that our 2023 payout estimate of $0.7400 per share for 2023-2027 seems too low. Just annualizing the latest dividend would bring the running rate to $0.80 per share and the analyst consensus for earnings is $0.91 in 2023 and $0.85 in 2024. An upward revision in our expectations is in order, which we will get to shortly.

In Line

Otherwise, though, BDC earnings season hewed very close to expectations in almost every way, not only where distributions are concerned. As discussed this weekend in the BDC Reporter, credit performance was not much different than the IVQ 2022 and most BDCs are performing well within "normal" ranges where underperforming assets; non-accruals and realized losses are concerned. There is a slight worsening underway but nothing that drastically changes what either the analysts or ourselves expect in terms of net asset value, earnings, or payouts.

On Everyone's Mind

Even in the venture-debt segment - where there are 5 full-time BDC players - credit conditions have held up, despite very low levels of new equity capital being added and the failure of Silicon Valley Bank (SVB). Except for a tiny minority of companies, everyone has enough "runway" in terms of liquidity to allow sponsors more time to decide what to do next. Maybe a little optimistically, several BDCs indicated on their conference calls that we might see "green shoots" in the second half of the year in terms of capital raised and companies sold or IPO-ed.

Not So Great

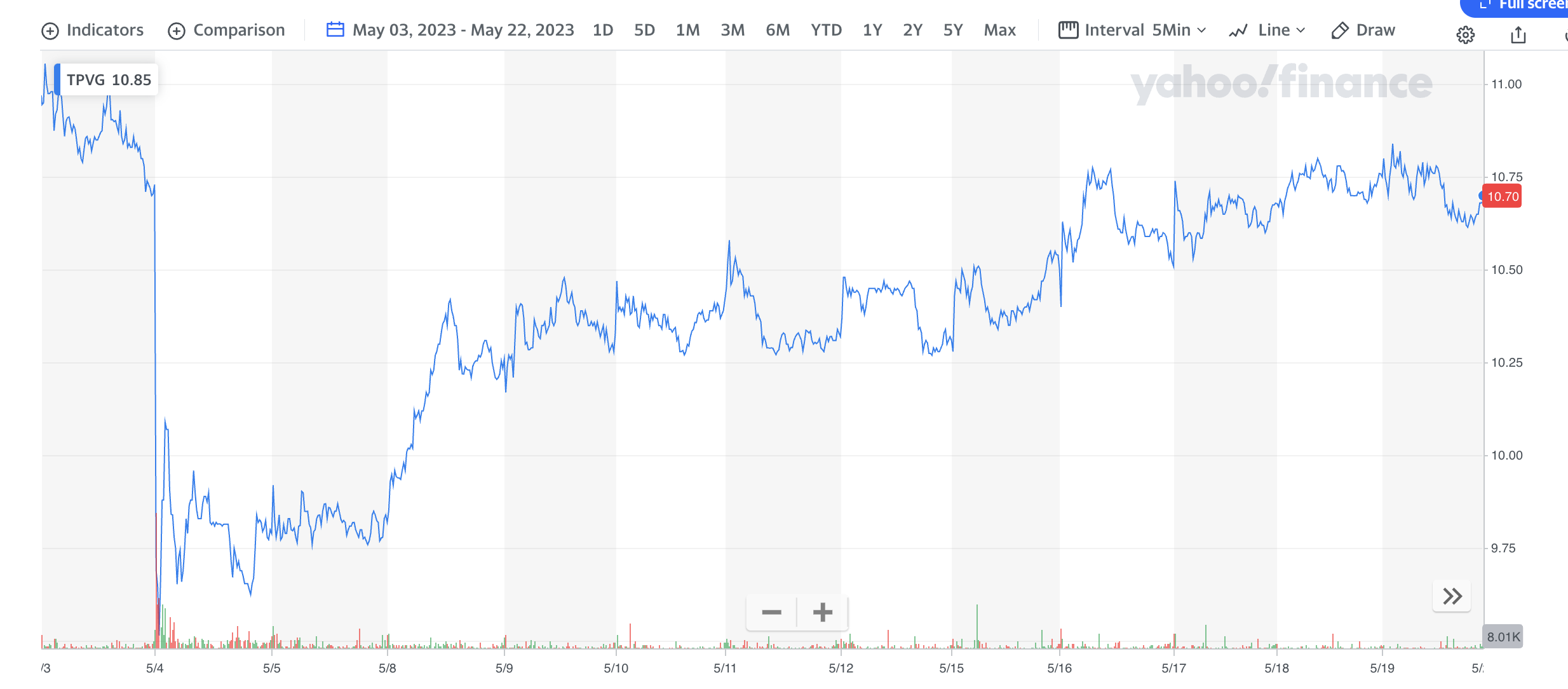

To be fair, TriplePoint Venture Growth (TPVG) did report an unusually high number of seriously underperforming or even bankrupt portfolio companies in the quarter. As you see below, that caused the stock to lose as much as (13%) of its value for a short while. The chart, though, also shows that investors had a re-think and TPVG's stock price has largely rebounded.

Flesh Wound

What happens next will depend largely on how well management does in mitigating realized losses. On its conference call, TPVG seemed to suggest - without making any explicit promises - that their position at the top of the balance sheet of the failing companies would allow them to escape with little permanent damage. These things seem to happen relatively quickly in the world of venture capital, so we'll find out soon enough. Our sister publication - the BDC Credit Reporter - will be tracking the performance of every TPVG underperformer on a daily basis as best we can.

Undeterred

Hopefully, the end result will not cause us to change our long-term projection of a TPVG annual dividend of $1.8800 in 2023. By the way, the analysts remain bullish enough, projecting a 2023 EPS of $1.9300. Annualizing the first quarter's earnings indicates an even better result: Net Investment Income Per Share of $2.1200. The BDC has $0.70 per share of spillover income as well. For the moment, our projection remains unchanged.

Frozen

Although we've been away for 3 weeks, not much has changed in terms of long-term BDC investing opportunities as prices have oscillated in a narrow range. None of the macro factors that are keeping a lid on BDC prices have changed. These are - in no particular order - higher interest rates; elevated inflation; concerns about a recession later in the year and lower levels of loan market activity. We've now had the longest period of BDCs trading at attractive prices that we've seen since 2007-2009. This has been happening even though BDC managers are waxing eloquent about this most-lender-friendly environment; the strength of their balance sheets and the outlook for the rest of 2023 for even higher earnings than the record-breaking levels set in the first quarter.

Valuation

Dull

BDC sector prices have been stuck in a narrow trading range ever since the fall of SVB - now ten weeks ago. As we've opined over at the BDC Reporter, we don't see what the immediate catalyst might be for a mighty rally, even if the sector increased 2.4% last week. As a result, these favorable conditions for acquiring BDC stocks with very high yields and near-record-level prospective returns may be with us for some time to come.