BDC Common Stocks Market Recap: Week Ended March 28, 2025 - ANNOTATED

March 29, 2025

Re-Printed From The BDC Reporter

BDC COMMON STOCKS

Week 13

For the week, the S&P (SP500) retreated -1.5%, while the tech-heavy Nasdaq Composite (COMP:IND) slid -2.6%. The blue-chip Dow (DJI) fell -1.0%.

seeking alpha-wall street breakfast – march 29, 2025

Unmistakable

Markets do not retreat in an orderly fashion. Prices do not drop by the same percentage every during a pull-back.

Yet, there’s no question that since February 19, 2025 when the S&P 500 closed at 6,144.15 a retreat is underway.

On Friday March 28, 2025, the S&P 500 was down to 5,580.94., or (9.2%) – very close to a “correction”.

Early in the week, investors spirits improved but, by the end, the S&P experienced its second worst day of the year.

Rinse and repeat.

Thanks to a good start to the year, the most watched index is down only (5.1%) in price terms and (4.8%) on a total return basis.

Not So Bad

The BDC sector – as measured by the price performance of its exchange traded fund with the ticker BIZD – continues to outshine the S&P 500 and all the major indices.

This week, despite a big dip on Friday, BIZD was up 0.9% to $16.86.

Since BIZD’s own peak on February 19, its price has dropped (5.4%).

That’s not nothing but a good deal less bad than the S&P 500.

Getting Into The Details

This week an equal number of BDCs moved up in price as moved down.

However, only two BDCs increased in price by more than 3.0%, while twice as many fell greater than (3.0%).

Saratoga Investment (SAR) – for some reason – has caught investors fancy and moved up 3.5%.

BlackRock TCP Capital (TCPC) – about which we’ve just written a long credit review article – moved up 3.4% as – once again – some hardy souls bet that a price bottom has been reached.

As this chart shows, TCPC’s stock price has dropped in half since the spring of 2021, but has also repeatedly moved up, only to fall again.

Downers

The big droppers – in percentage price terms – were Portman Ridge (PTMN), down (6.2%); followed by newly public MSC Investment (MSIF) off by (4.2%), with CION Investment (CION) down (3.6%) and Palmer Square (PSBD) (3.1%) lower.

In terms of 52 highs and lows, by our count there was only one – PTMN – which reached a 52 week nadir.

Not Much

There was little in the way of market-moving BDC-specific news.

At long last, the IVQ 2024 BDC earnings season came to an end with Investcorp Credit Management’s (ICMB) results.

Not unexpectedly, ICMB did not perform all that well. Most notably, the BDC’s Net Asset Value Per Share (NAVPS) dropped by (2.9%).

Worryingly for the BDC’s shareholders, Net Investment Income Per Share (NIIPS) only came to $0.06 but the quarterly dividend was $0.12.

In the next two quarters, the analysts are projecting ICMB’s NIIPS will only reach $0.11, so you see the problem ahead…

Getting Bigger

As expected, the shareholders of both Carlyle’s BDCs – the public one (CGBD) and the non-traded one – Carlyle Secured Lending III – agreed to merge.

The shareholders are promised “strategic benefits” and that the combination will “create long-term value through increased portfolio scale and efficiency”.

That’s in the future. Right now CGBD is trading at $16.72 a share – and as this chart shows – is well off in price in 2025:

Snapshot

We are now a neat one quarter of the way into a tempestuous 2025 and BIZD is still in the black YTD: 1.4% in price terms.

The S&P BDC Index – calculated using a different methodology than BIZD and including all dividends received so far – is up 1.2%.

As we’ve noted above, BDCs are doing way better than the S&P 500, down (5.1%) in price terms and (4.8%) on a total return basis.

At this point in 2025, 22 BDCs are up in price and 24 are down.

The number of BDCs trading at or above their NAVPS is 15. At the end of 2024 this metric amounted to 13 and reached a high of 20.

4 BDCs are trading within 5% of their 52 week highs and 9 are within 5% of their 52 week lows.

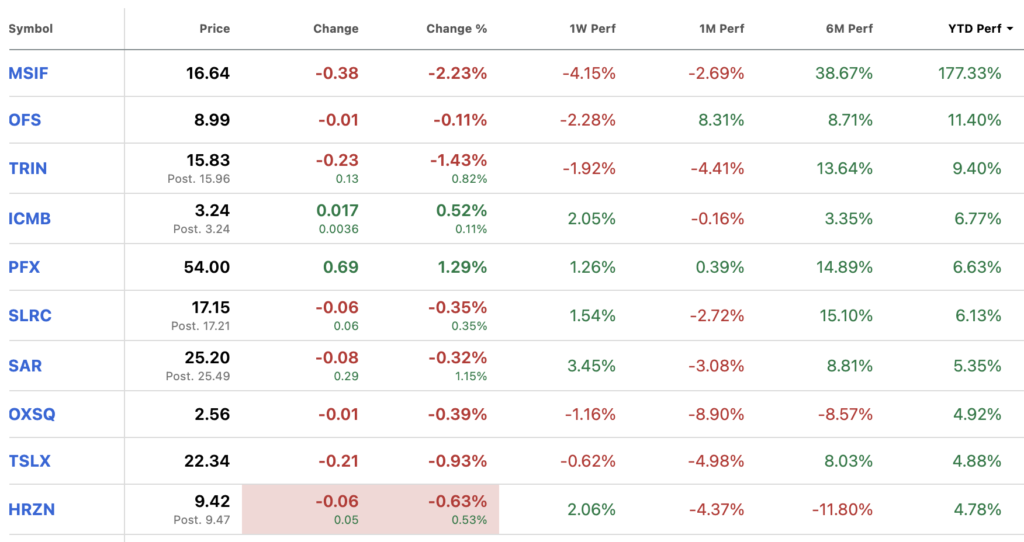

Here are the ten top BDCs in terms of percentage price increase in these first 13 weeks - see the last column:

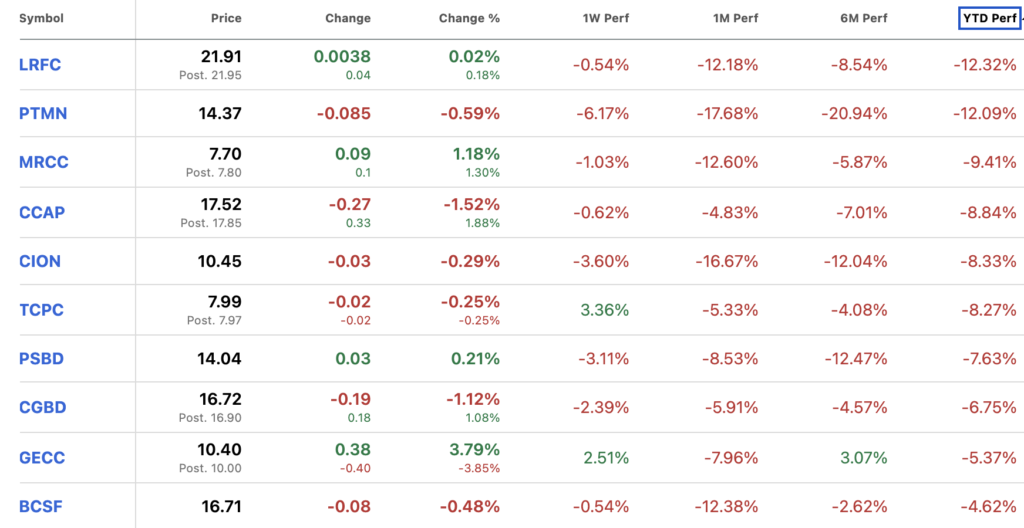

These are the ten”worst” price performers:

Where We’re Going

Same Old

As usual, the future is a mystery and no more so than right now with uncertainty writ large in the interest rate, economic and political environment – all of which are increasingly inter-related.

Making matters even more difficult to divine, much of the confusion that has become our daily bread, is of very recent origin.

As a result, there has been very little observable impact on the BDCs and their portfolio companies to evaluate.

In addition, we don’t like to take dire forecasts from our friends in the dismal science too seriously nor the endless comments coming from the Fed governors, each of whom seems to have a different take when being interviewed but seem to vote almost unanimously when they gather together.

One can find in the zeitgeist whatever one’s own pre-conceptions might be, a dangerous sort of echo chamber.

This week, we noted that a Deutsche Bank survey put the chances of a U.S. recession “as approaching 50%”. (The actual number was 43%). Fitch cut both its world and U.S. economic growth forecasts, while Atlanta Federal Reserve President Raphael Bostic “now sees the Fed cutting its benchmark interest rate only a quarter of a percentage point by the end of this year”. That’s in contrast with the 2 or 3 cuts most everyone else projects.

No Thanks

All the above seems credible and in line with our own instincts but the data is not clear cut enough to rely on so we remain agnostic. Or, put another way, we have no idea what tomorrow and the day after might bring.

All we’ll say is that the evidence suggests BDC investors have largely avoided panicking in recent weeks and a fundamental optimism about the outlook for credit – and the still very high yields to be harvested – remains.

At times of market stress, we like to see how investor favorites perform.

Close By

Ares Capital (ARCC) – for example – is trading (7%) off its 52 week high and 14% above its 52 week low.

Main Street Capital (MAIN) is (11%) off the high but 26% above the low.

Both trade well above book, especially MAIN.

We interpret this as meaning that investors may have taken some money off the table – both BDCs were recently breaking all-time price records – but have not gone off very far.

There is “no blood in the streets” – i.e. no sense of panic, just a quiet resignation and a wait-and-see attitude.

That’s exactly what we are going to do.